New information on sick leave payments. How to calculate sick leave (calculation example)

Social insurance benefits are calculated based on the employee’s average earnings (Part 1, Article 14 of Law No. 255-FZ of December 29, 2006). At the same time, this average earnings cannot exceed the sum of the maximum values of the base for calculating insurance contributions to the Social Insurance Fund for 2 years included in the billing period (Part 3.2 of Article 14 of the Law of December 29, 2006 No. 255-FZ). That is, by calculation it is always possible to determine the maximum amount of sick leave that can be paid to an employee for a specific period of time.

So, if an insured event occurs in 2018, the employee’s benefit should be calculated based on his average earnings in 2016-2017. In 2016, the contribution base limit was 718,000 rubles, and in 2017 - 755,000 rubles. (Clause 3 of Article 421 of the Tax Code of the Russian Federation, Government Decrees No. 1265 dated November 26, 2015, No. 1255 dated November 29, 2016). Accordingly, as a general rule, the maximum amount of sick leave in 2018 will be calculated based on the average daily earnings equal to RUB 2,017.81. ((RUB 718,000 + RUB 755,000) / 730 days).

Maximum sick pay in 2018, taking into account length of service

The amount of sick leave in most cases depends on (Part 1 of Article 7 of the Law of December 29, 2006 No. 255-FZ). This means that length of service also affects the maximum amount of sick leave in 2018.

Maximum amount of sick leave in 2018 for pregnancy and childbirth

If the employee’s length of service is , then maternity benefits are paid to her based on 100% of average earnings not exceeding the maximum limit, that is, 2,017.81 rubles/day. Since such a benefit is usually assigned for 140 calendar days (Article 255 of the Labor Code of the Russian Federation), its maximum amount will be: 282,493.40 rubles. (RUB 2,017.81 x 140 days).

The maximum amount of sick pay in 2018 based on the minimum wage

In certain cases, benefits are calculated based on. At the same time, the maximum sick leave per month cannot exceed the minimum wage, that is, from 05/01/2018 - 11,163 rubles. (Federal Law No. 41-FZ dated 03/07/2018).

Payment of sick leave: maximum number of days

For the case when the employee himself fell ill or was injured, the maximum period of sick leave in 2018 (period of incapacity for work) has not been established (Part 1, Article 6 of Law No. 255-FZ of December 29, 2006). In other words, he will need to be paid benefits for the entire period specified in the sick leave. But if the employee was released from work due to the need to care for a child or other family member, then what the employer (or Social Insurance Fund in the regions where the pilot project has been launched) must pay will be limited.

The calculation of sick leave in 2017 - 2018 has changed. Please note that the billing period and the amount of payments taken into account have changed, and the maximum average daily earnings have increased. To avoid getting confused in the calculation, look at examples using specific numbers.

Calculation of sick leave in 2017 and 2018 is phased. The accountant determines:

- billing period; employee's average daily earnings; employee's insurance record;

- daily allowance amount;

- the total amount of sick leave payment.

Apply this calculation procedure regardless of the cause of disability (illness of the employee himself, a member of his family, domestic injury, industrial accident, etc.). Below we present the calculation of sick leave in 2017 and 2018.

Please note: the rules for calculating hospital benefits are different in 2017 and 2018. Experts warn about this. Read the transcript of the lecture in the program “” in the course “What has changed in the calculation of benefits.”

How to calculate sick leave in 2017

To calculate sick leave in 2017, take the employee’s salary for 2015 and 2016. These years are called the calculation period. The formula for looks like this:

Use the same formula to calculate benefits in 2018, only take payments for the other period. For details, see the section "How to calculate sick leave in 2018."

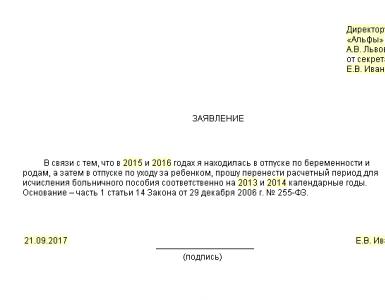

It is possible that one or both years of the billing period included maternity or child care leave. The employee can then replace pay period years with prior years if doing so would result in an increase in benefits. To do this, the employee must submit an application to the employer (sample below).

According to officials, replacement years must necessarily precede the billing period (letter of the Ministry of Labor of the Russian Federation dated August 3, 2015 No. 17–1/ OOG-1105). Although Law No. 255-FZ does not establish such restrictions.

After you have determined the billing period, calculate the earnings on the basis of which sick leave is calculated in 2017 and 2018.

Earnings for the billing period for sick leave in 2017

In your earnings, include all payments for the billing period from which you paid contributions to the Federal Social Insurance Fund of Russia (Part 2 of Article 14 of Law No. 255-FZ, Clause 2 of the regulation approved by Decree of the Government of the Russian Federation of June 15, 2007 No. 375).

Accordingly, all payments that are not subject to insurance contributions must be excluded from the employee’s total earnings for the billing period (Part 2 of Article 14 of the Law of December 29, 2006 No. 255-FZ). In particular, these are:

- government benefits;

- statutory compensation payments to employees;

- financial assistance not exceeding 4000 rubles. per year per person.

A complete list of payments exempt from insurance premiums is given in Article 9 420 of the Tax Code of the Russian Federation. For example, insurance premiums are not imposed on payments under civil contracts or for the purchase of property or property rights. For more information about this, see the recommendation "".

Compare payments in each year of the billing period with the maximum contribution base. For convenience, we have provided information on contribution limits in the table below.

Table. Limit values of the base for calculating social contributions

If in any year the total earnings exceeded the limit of insurance payments, then take this limit value to calculate sick leave. Do not take into account everything that is above this year.

Example:

P.A. Bespalov has been working in the organization since August 2006. His salary is 15,000 rubles. From February 3 to February 24, 2015, Bespalov was on vacation. For February, he was accrued vacation pay in the amount of 10,000 rubles. and salary - 3000 rubles.

In March 2015, Bespalov received an additional payment for working on weekends in the amount of 3,182 rubles. From May 18 to May 22, 2017, Bespalov was ill, which was confirmed by a sick leave certificate.

The calculation period for calculating benefits is from January 1, 2015 to December 31, 2016. When determining total earnings, the accountant took into account all payments and additional payments that are subject to contributions to the Federal Social Insurance Fund of Russia.

Thus, Bespalov’s earnings for the billing period for the purposes of calculating sick leave benefits are:

- in 2016 – 180,000 rubles. (RUB 15,000 ? 12 months),

- in 2015 – 181,182 rubles. (15,000 rub.? 11 months + 10,000 rub. + 3,000 rub. + 3,182 rub.).

Earnings do not exceed the contribution limit, so sick leave in 2017 must be calculated based on payments in the amount of 361,182 rubles. (RUB 180,000 + RUB 181,182).

The amount of payments for the billing period must be compared with the value of 24 times the minimum wage established on the date of the onset of temporary disability. If payments for the billing period turn out to be less, then when calculating average earnings it will be necessary to use exactly 24 times the minimum wage (Part 1.1 of Article 14 of Law No. 255-FZ).

If you make a mistake in calculating benefits, you will end up with arrears or overpayment of contributions. To prevent this from happening, count sick leave in. Free trial access to the program is valid for 30 days.

Average daily earnings for sick leave in 2017

Average daily earnings for calculating sick leave in 2017 are determined based on earnings accrued in 2015 - 2016. To do this, the total income is divided into 730 days. This procedure is prescribed in Part 3 of Article 14 of Law No. 255-FZ.

The maximum average daily earnings for benefits is 1901.37 rubles. [(RUB 670,000 + RUB 718,000) : 730 days]. If an employee earned more over the previous two years, you calculate benefits from the new maximum average earnings of 1,901.37 rubles.

Example:

Employee A.S. Kondratiev was ill from February 9 to February 16, 2017. The calculation period included 2015 and 2015. During this time, the employee was accrued 365,000 rubles. Kondratyev worked out the billing period completely. Kondratiev’s average daily earnings are 500 rubles. (RUB 365,000: 730 days).

Total amount of sick leave benefits in 2017

For the list of periods included in the length of service, see Article 16 of Law No. 255-FZ and paragraphs 2 and 2.1 of the Rules approved by Order of the Ministry of Health and Social Development of Russia dated February 6, 2007 No. 91.

We have presented how an employee’s insurance length affects the amount of daily benefits in the table below.

Irina Savchenko answers,

Head of the department for monitoring the implementation of calculation and assignment of insurance coverage of the department for organizing the provision of insurance payments of the Federal Insurance Service of Russia

“Determine the insurance period on the day of the onset of temporary disability (clause 7 of the Rules, approved by order of the Ministry of Health and Social Development dated 02/06/2007 No. 91). Include periods of insurance in your insurance period...”

Table. Experience for calculating sick leave in 2017 and 2018

Once the amount of the daily benefit is determined, you can make the final calculation for sick leave in 2017. To do this, the daily allowance must be multiplied by the number of days of illness.

Example:

Let’s use the conditions of the previous example and assume that Kondratiev’s employee has more than 8 years of experience. Accordingly, the sickness benefit is 4,000 rubles. (500 RUR x 100% x 8 days).

Calculation of sick leave benefits in 2017 upon dismissal

The employer must pay for the entire period of illness of the resigned employee. A common mistake: organizations pay sick leave to former employees based on their length of service. And only within 30 days after dismissal. But everything needs to be the other way around.

If a former employee falls ill within 30 calendar days from the date of dismissal, he must be paid for the entire period of illness (Clause 2, Article 5 of Law No. 255-FZ). Even if he got sick on the 30th day. At the same time, the amount of benefits to a former employee is 60 percent of his earnings, regardless of length of service (Clause 2, Article 7 of Law No. 255-FZ).

Example:

Petrov S.A. resigned from Vector LLC on February 27, 2017. On March 24, he fell ill and was on sick leave for 7 calendar days. The billing period is 2015 - 2016. The employee’s work experience is more than 10 years, but still the amount of the benefit will not exceed 60 percent of his average earnings.

Petrov earned 780,013.15 rubles in 2015, and 852,746.88 rubles in 2016, which is more than the limits for 2015 and 2016. This means that the benefit amount will be equal to 7985.75 rubles. [(670,000 + 718,000) : 730 days. ? 60% ? 7 days].

How to calculate sick leave in 2018

In 2018, sick leave must be calculated in a new way. The fact is that in 2018, the calculation period for benefits includes 2017 and 2016. Because of this, the maximum daily earnings have increased.

For 2017, payments within the range of 755,000 rubles can be taken into account when calculating sick leave, and for 2016 – within the range of 718,000 rubles. That is, the maximum average daily earnings for benefits in 2018 is 2,017.81 rubles. [(RUB 755,000 + RUB 718,000) : 730 days].

Important: you can automatically determine the amount of sick leave in " ". Documents for the Social Insurance Fund are generated at the time of settlement. You can try it for free right now.

Calculation of sick leave benefits in 2018: example

The employee was sick for five calendar days - from January 15 to 19, 2018. The billing period is 2016-2017. In 2016, the employee’s earnings amounted to RUB 540,500.00, and in 2017 - RUB 587,500.00.

During the billing period, the employee was sick for 14 calendar days. But this does not affect the calculation of sick leave benefits. Earnings for two years for temporary disability benefits must be divided by 730. Therefore, the average daily earnings is 1,545.21 rubles. [(RUB 540,500 + RUB 587,500) : 730 days].

The employee's insurance experience is four years. This is less than five years, so the benefit will be 60 percent of average earnings: 4,635.63 rubles. (RUB 1,545.21 x 60% x 5 days).

Payment of sick leave in 2017 – 2018

Sick leave due to illness or injury is paid from the following sources (clause 1, part 2, article 3 of Law No. 255-FZ):

- for the first three days of incapacity - at the expense of the employer;

- >for the remaining days - at the expense of the Social Insurance Fund.

A sick leave issued in connection with caring for a sick family member, quarantine of an employee or his child attending a kindergarten, after-care in a sanatorium in the Russian Federation after the provision of medical care in a hospital setting, as well as in other cases, is paid for from the Social Insurance Fund from the first days of incapacity for work (Part 3 of Article 3 of Law No. 255-FZ).

We will not talk now about to whom and in what cases certificates of incapacity are issued. Suffice it to say that the moment an employee submits sick leave to the accounting department, a rather complex process of calculating benefits begins. A lot of articles have been written about how to calculate it correctly.

We will try to describe the entire process, starting from the moment when the sick leave lands on the accountant’s desk and until the employee receives all the payments due to him in this case, in the form of step-by-step instructions. This article will be of interest to both employers and their employees who want to understand in detail the process of paying sick leave.

So, taking into account all changes in legislation for 2017 and 2018, the calculation is as follows:

Step 1. We accept a certificate of incapacity for work from the employee

Before taking a document from an employee, check its authenticity and correctness. After all, it depends on whether the FSS will reimburse you, as an employer, for these amounts.

- The sick leave sheet must be printed on special paper with watermarks, have multi-colored fibers, the color in the center is lighter than at the edges, the cells for notes have a yellowish tint. More details about this can be found on the foundation's website. There is always information about stolen forms there.

This is what a sick leave certificate approved on July 1, 2011 and currently valid, including for 2016, looks like:

Download the sick leave form for printing. In the archive (27 MB) you will find a blank form of a certificate of incapacity for work, as well as a description of all its protective elements.

Our lawyers know The answer to your question

or by phone:

- Next we check the design: Entries must be either typed or written in black gel pen. The certificate of incapacity for work can be primary, continuation, or duplicate. Each case has its own mark - a “primary” checkbox, the previous sick leave number, a “duplicate” checkbox, respectively. It must be remembered that the date of issue of the document may be the day of visiting the doctor, or the next day (when the employee goes to the hospital at the end of the work shift) the day of issuing a duplicate or discharge from the hospital.

- Next, we check the employee’s last name, first name, patronymic, date of birth, and dates of illness. Do not forget that without the signature of the chairman of the VC there can be a sick leave for up to 15 days. The exception is maternity leave (hereinafter, Maternity leave), but we will dwell on it in more detail later.

- We check the presence of the seals of the organization that issued the document and the signatures of the doctors. Next, if the employee is discharged from sick leave, check the date from which he begins to perform work duties - this should be the day after the end of the illness. In case of extension, a special code is entered - “31”, or another if it is, for example, follow-up treatment and the number of the next certificate of incapacity is entered.

All these points are spelled out in special FSS documents. By the way, quite often controversial situations arise when doubts remain about the correctness of the certificate of incapacity for work. In this case, you can always contact the fund to which your organization belongs, in writing or orally. As a rule, there is a special department for working with sick leave, and its specialists are always happy to advise on this issue.

Video instructions from the Social Insurance Fund for filling out a sick leave certificate:

So, the document is genuine and filled out correctly. You have every right to take it into account. From this moment on, the accountant must accrue benefits within 10 days, and then pay them with the next salary transfer. As a rule, payments fall into the calculation or advance.

Step 2. Calculate sick leave benefits

We determine the billing period - it is equal to two calendar years preceding the period in which the employee fell ill.

Next, we calculate the average daily earnings, for which all amounts accrued to the employee over these two years, namely those that should be subject to contributions, must be divided into 730 days of the billing period. We compare the result obtained with the limit - the amount above which payment at the expense of the Social Insurance Fund cannot be made.

In 2015, the maximum that can be paid in one day is 1,632 rubles. 88 k., in 2016 it will be 1,772 rubles. 60 k. This figure is obtained by adding up the limits on insurance premiums in the years of the billing period and dividing this amount by 730.

This year we add up 568 thousand and 624 thousand rubles for 2013, 2014, respectively, next year (2016) it will be 624 thousand and 760 thousand rubles for 2014, 2015. Thus, it turns out that in 2015 the amount of average earnings for calculating benefits cannot exceed 1,192 thousand rubles.

So, we have calculated the average daily earnings. Now we need insurance experience, since the amount of benefits paid depends on this.

If the employee had worked for less than six months at the time of illness, then sick leave is calculated from the minimum wage (RUB 5,965 in 2015) plus the regional coefficient. If the length of service is from six months to five years, then sick pay will be equal to 60% of average earnings, from five to eight years - 80%, more than eight - 100%.

Here we must make a reservation that from 2016 these parameters will increase by six months annually. That is, in 2016, the internship periods will be up to five and a half years, then - up to eight and a half or more. From 2017, they will increase by another six months, and so on until 2029, when an employee with more than 15 years of experience will be able to receive 100% of the benefits. To date, this bill has not yet been approved.

Let us also recall that length of service is counted from the start of work until the day preceding the illness.

Now we must multiply the calculated amount of average daily earnings, calculated taking into account length of service, by calendar days of illness.

Formula for calculating sick leave benefits

So, the formula for calculating sick leave is as follows:

- Average daily earnings= (Earnings for 2 calendar years preceding the period of illness (taking into account the maximum values)) / 730 days;

- One day allowance= (Average daily earnings) * (Percentage, depending on length of service (100, 80, 60%))

- Final amount= (Benefit for one day) * (Days of illness).

Online sick leave calculator

Our lawyers know The answer to your question

or by phone:

You can use this calculator to calculate sick leave in 2015, 2016 and subsequent years. All changes in legislation are promptly introduced into its work algorithm.

Step 3. Pay benefits

If the region in which you work is not included in the pilot project (when benefits are paid directly by the Social Insurance Fund), then the employer is responsible for the payment. Knowing the final amount of the benefit, you need to subtract 13% of personal income tax from it and include it in the payment statement.

Example of sick leave calculation

Let's look at calculating sick leave using a specific example:

In March 2015, an employee of the organization A.B. Ivanova was on sick leave for 5 days.

She worked for a total of more than nine years, accordingly, she is entitled to 100% benefits.

The billing period includes the 2013-2014 calendar years.

The worker’s actual earnings during this time amounted to 567,325 rubles. and 628,415 rubles. respectively

As we can see, income in 2013 was no more than the limit, but next year the limit was exceeded. Therefore, when calculating benefits, the entire amount for the first year and the maximum 624 thousand rubles are taken. for the second.

The average daily earnings will be, respectively, (567,325 rubles + 624 thousand rubles)/730 days. = 1,631.95 rub.

Therefore, the benefit for the entire period of illness will be:

RUB 1,631.95/day* 5 days = 8,159.76 rub.

Payment due RUB 8,159.76 - 1,061 rub. (NDFL) = 7,098.76 rubles.

That, in fact, is the whole calculation. All that remains to be added is that the first 3 days of benefits are paid by the employer, the rest are paid by the Social Insurance Fund. The exceptions are benefits for employment and childcare - they are paid entirely from the fund.

Let us dwell on them in more detail, since their calculation is somewhat different from the usual one.

Sick leave for pregnancy and childbirth (BiR)

The duration of maternity leave is, as a rule, one hundred and forty days: the first seventy days are the prenatal period and the subsequent ones are the postpartum period. In case of difficult childbirth, an additional certificate of incapacity for work is issued for another 16 days. If the pregnancy is multiple, the benefit is issued for a period of 194 days (84+110).

The duration of maternity leave is, as a rule, one hundred and forty days: the first seventy days are the prenatal period and the subsequent ones are the postpartum period. In case of difficult childbirth, an additional certificate of incapacity for work is issued for another 16 days. If the pregnancy is multiple, the benefit is issued for a period of 194 days (84+110).

The calculation period, as in the case of sickness benefits, is the two previous calendar years. But then the significant differences begin.

Firstly, the days into which the earnings accrued in the billing period are divided are not necessarily equal to 730. It can be 731 if one of the years of the billing period has 366 days, 732 if both years are leap years. Secondly, excluded periods are subtracted from this number, which include:

- disease;

- maternity leave;

- parental leave;

- a period when the employee does not work, but receives any payments that are not subject to contributions.

Thirdly, it remains possible to replace one or two years of the billing period if at that time the employee was on maternity leave or caring for a child up to one and a half or three years old. Instead, you can take any previous year. The most important thing is that the benefit in this case will be greater than without this replacement. In this situation, the employee must write a statement indicating which years she wants to replace with others.

An example of calculating sick leave according to BiR

For example, employee V.G. Petrova worked at the company for five years. In the years preceding her maternity leave, she was on leave to care for her first child.

Petrova returned to work in April 2015. And from October 3, 2015, I went on maternity leave again. During the billing period, she was accrued only sick leave according to BiR and benefits for up to one and a half years. They are not subject to contributions and, therefore, there is no salary amount for calculating benefits.

The employee wrote a statement and the years preceding her pregnancy were replaced with those in which she worked full time - these are 2012 and 2011.

Average daily earnings for BIR benefits= Earnings for two calendar years preceding the BIR period (taking into account the maximum values) / 730 (731 or 732) - days of excluded periods.

Next, we compare the calculated average daily earnings with the maximum amount, which remains the same as in the case of regular sick leave. That is, in 2015 it is 1,632 rubles. 88 k. If the calculated amount is less, then we multiply it by the days of benefit, but if it is more, then we take the maximum amount. That is, in 2015, the maximum that can be received for maternity leave will be 1,632 rubles. 88 k. *140 days = 228,603 rub. 20 k.

Let's look at the calculation using an example:

Enterprise employee D.E. Sidorova is going on leave from 01/17/2015, which will last 140 days (from January 17 to June 4, 2015).

Work experience exceeds 6 months.

The years for calculating benefits are 2013, 2014.

Salary for this period: 618,100 rubles. and 752,234 rubles, respectively.

From these amounts, contributions to the Social Insurance Fund have been paid in full.

Since the employee’s earnings exceed the limit values, the calculation should be made based on the maximum amount of 1,192 thousand rubles.

There are 730 days in the billing period, of which Sidorova was on sick leave for 19 days, therefore, we will calculate the average daily earnings based on the calculation of 730-19 = 711 calendar days:

The calculation of such sick leave does not differ from the usual one, with one exception. This is the time for which the employee can count on payments:

- If the child’s age is less than seven years, then the benefit is paid for the entire period, but not more than 60 days during the year (90 for special diseases approved by law). Moreover, if a child is undergoing treatment at home, then the first ten days must be paid in the usual manner, the next - in the amount of 50%. If the child is in a hospital, payment is made at the usual rate for the entire duration of treatment.

- If an employee is caring for a child whose age is from seven to fifteen years, then payment is subject to 15 days at a time, but not more than 45 days a year.

Here's an example:

I.S. Ledeneva brought to the accounting department a sick leave for child care from March 11 to March 26, 2015 (16 days). The child is six years old, this year he is sick for the first time, treatment is outpatient (at home). Consequently, all 16 days are subject to payment, of which the first ten are at the usual rate, the rest at 50%.

The total experience of the employee is more than seven years. Therefore, the first ten days must be paid at 80%. And the next six are half size. Earnings in 2013, 2014 calculation period amounted to 451,013.90 rubles. and 518,732.59 rubles. respectively.

These amounts are less than the limit, so we calculate the benefit as follows:

(RUB 451,013.90 + RUB 518,732.59)/730 days. x 80% x 10 days = 10,627.40 rub. (10 days);

(RUB 451,013.90 + RUB 518,732.59)/730 days. x 50% x 6 days. = 3,985.26 rub. (6 days).

The total amount for the certificate of incapacity for work will be 14,612.66 rubles. (RUB 10,627.40 + RUB 3,985.26).

This entire amount is reimbursed by the FSS.

One more nuance - if the employee was on leave to care for children during sick leave, the benefit is not accrued and the leave is not extended for this period.

This is not all that can be said about the calculation of benefits, but we tried to briefly outline the main points. By 2016, as mentioned above, we should expect changes in the length of service; you also need to be careful with the maximum and minimum values, since they are indexed annually, which means they will differ from the values of the current year. But in our online calculator, all these values change automatically, so you can safely use it to calculate sick leave benefits in 2016 and subsequent years.

If you still have any unresolved questions on this topic, then our online lawyer is ready to advise you free of charge and promptly right on the website. You can ask your question in the form at the bottom of the page.

The indexation coefficient for a one-time benefit at the birth of a child, for registration in the early stages of pregnancy, and the minimum amount of child care benefits for children up to one and a half years old has not been approved. These benefits will be indexed separately by the Government no earlier than February. Until this point, you need to use the benefits established in 2015. Maternity benefits and sick leave are not indexed. They should be calculated based on average earnings for 2014 and 2015. See this article for more details.

14.01.2016Benefits in the Social Insurance Fund can be divided into two parts:

1. children (related to pregnancy, childbirth, birth and child care)

2. sick leave (due to employee illness)

In this article we will talk about all these benefits. And pay attention to our table - it shows the amount of benefits taking into account indexation from February 1, 2016 until indexation.

Amounts of benefits in the Social Insurance Fund, taking into account indexation in 2016, table

|

Maximum monthly child care benefit |

RUB 21,554.82 |

RUB 21,554.82 |

||||||

|

Minimum amount of maternity benefit |

28,555.4 rub. (for multiple pregnancy - 39,569.62 rubles, complicated childbirth - 31,818.87 rubles). |

28,555.4 rub. (for multiple pregnancy - 39,569.62 rubles, complicated childbirth - 31,818.87 rubles). |

||||||

|

Maximum amount of maternity benefit |

RUB 248,164 (for multiple pregnancy - 343,884.4 rubles, complicated childbirth - 276,525.6 rubles). |

|||||||

|

Minimum average daily earnings for calculating benefits (based on the minimum wage) |

||||||||

|

Maximum average daily earnings for calculating benefits |

||||||||

|

Calculation period for calculating sick leave |

Reimbursement of benefits from the Social Insurance Fund in 2016 (benefits from the Social Insurance Fund in 2016) Employers have the right to reimburse all types of benefits from the Social Insurance Fund. Exception: the amount of sick leave benefits accrued to the employee for the first three days of incapacity, provided that the employee himself fell ill and not a member of his family (child). The fact is that temporary disability benefits are paid depending on the reason for issuing sick leave:

From the first day, the benefit is reimbursed by the FSS of Russia if a certificate of incapacity for work is issued, for example, in connection with caring for a sick family member (including a child) or in connection with an industrial accident or occupational disease. If the employee himself falls ill and the disability is not related to any work injury or occupational disease, then the temporary disability benefit for the first three days of the employee’s illness is paid by the organization at its own expense. From the fourth day of illness, the amount of the organization’s benefit is reimbursed by the FSS of Russia (subclause 1, clause 2, article 3 of Federal Law No. 255-FZ of December 29, 2006, hereinafter referred to as Law No. 255-FZ). How much do employers pay benefits for the birth of a child in 2016 (one-time benefit in 2016)There are two types of benefits associated with the birth of a child, which are paid by the employer, and then reimburse the amount of these benefits from the Social Insurance Fund. The first is a one-time benefit for women who register with medical organizations in the early stages of pregnancy. See the table for its size in 2016. The second is a one-time benefit for the birth of a child. Its size is also indicated in our table. The government has indexed these sizes since January 1, 2016. Documents for assigning benefits to the Social Insurance Fund

When do you need to pay Social Security benefits in 2016 (payment of benefits)The FSS benefit must be assigned in 2016 within 10 calendar days after the employee has submitted the documents serving as the basis for calculating the benefit. The benefit is paid on the day closest to the date of payment of the benefit, which is set for the payment of wages. In this case, the lump sum benefit for the birth of a child must be paid within the same 10 days that are provided for calculating the benefit. The same applies to a one-time benefit for women registered in medical institutions in the early stages of pregnancy, if the certificate of registration in the early stages of pregnancy is submitted later than the sick leave certificate (clause 1, article 15 of Law No. 255-FZ, clause 24 and 30 Order No. 1012n). How much do employers pay Social Security benefits for children under 1.5 years of age in 2016?The childcare benefit for a child up to one and a half years old is calculated as follows (clause 1, article 11.2 and clause 5.1, article 14 of Law No. 255-FZ): The maximum average daily earnings, on the basis of which child benefits are calculated in 2016, is 1,772.60 rubles. [(RUB 670,000 + RUB 624,000) : 730 days]. This means that the maximum monthly benefit for a child in the Social Insurance Fund up to 1.5 years old in 2016 is 21,554.82 rubles. Days excluded from the calculation period when calculating maternity and child benefits to the Social Insurance Fund in 2016 (clause 3.1 of Article 14 of the Federal Law of December 29, 2006 No. 255-FZ)Next, the actual calculated average daily earnings are compared with the minimum. It is determined based on the minimum wage in the manner prescribed in paragraph 15(3) of the Regulations approved by Decree of the Government of the Russian Federation dated June 15, 2007 No. 375. The minimum average daily earnings for calculating child benefits in 2016 is (minimum wage × 24 months: 730 days). After comparing the actual average daily earnings and the minimum amount, the larger amount is assigned to payment. Please note that child benefits are not subject to personal income tax and insurance contributions (clause 1 of article 217 of the Tax Code of the Russian Federation and subclause 1 of clause 1 of article 9 of the Federal Law of July 24, 2009 No. 212-FZ and subclause 1 of clause 1 of article 20.1 Federal Law dated July 24, 1998 No. 125-FZ). Example 1. Calculation of benefits for child care up to 1.5 years in 2016E.A. Panteleeva has been working at Fitness Class LLC as an instructor since 2012. From June 1, 2016, she goes on maternity leave for up to one and a half years, about which she wrote a corresponding statement. This is Panteleeva’s first child. The calculation period for calculating benefits is two calendar years: 2014 and 2015. In 2014, Panteleeva was sick for 21 calendar days, and in 2015 she was on sick leave for 5 days. There are no other grounds for excluding days from the billing period. For 2014, Panteleeva’s salary amounted to 450,000 rubles, and for 2015 - 538,000 rubles. Receipts for 2014-2015 did not exceed the limit values, therefore, when calculating benefits, they will be taken into account in full. Considering that in 2014-2015 Panteleeva was on sick leave for 21 and 5 days, the duration of the billing period will be 704 calendar days (730 - 26). The average daily earnings of a female worker is 1,403.4 rubles. [(RUB 450,000 + RUB 538,000) : 704 days]. This value does not exceed the established maximum average daily earnings (RUB 1,403.4).< 1 772,60 руб.). Поэтому детское пособие будет рассчитано исходя из фактически начисленного среднего заработка сотрудницы. Now let's calculate the monthly child care allowance. It will be 17,065 rubles. (RUB 1,403.4 x 30.4 days x 40%). The calculated benefit amount is greater than the established minimum wage. So, E.A. Panteleeva will receive a monthly allowance for child care up to one and a half years old in the amount of 17,065 rubles. How to calculate child care benefits for less than a monthLet’s say an employee’s maternity leave ends in the middle of the month, then the benefit for a child under 1.5 years old in 2016 needs to be determined for less than a full month. In this case, the benefit is calculated in proportion to calendar days (including weekends and holidays). Then the calculation of benefits is done according to the formula (clause 47 of the Procedure, No. 1012n): Example 2. Calculation of child care benefits for children up to 1.5 years old, if parental leave began in the middle of the month Let's use the conditions from example 1, changing them slightly. Let’s assume that Panteleeva, an employee of Fitness Class LLC, went on maternity leave for a child of up to one and a half years from June 11, 2016. The amount of benefit for a full month, which was calculated by Panteleeva, amounted to 17,065 rubles. There are 30 calendar days in June, of which only 20 days are vacation days. Thus, for June 2016, Panteleeva is entitled to a benefit in the amount of 11,376.6 rubles. (RUB 17,065: 30 days × 20 days) How the amount of sick leave benefits depends on the employee’s insurance recordCalculation of sick leave in 2016: rulesWhen calculating sick leave benefits in 2016, you need to pay attention to the new maximum average daily earnings. But first, let us recall the formula by which the average daily earnings are determined (clause 1, article 14 of Law No. 255-FZ and clause 15(1) of Regulation No. 375): Please note: the number 730 here is not subject to any adjustment. This is a fixed value, and it does not depend on whether the billing period falls in a leap year or not. Thus, the maximum average daily earnings, on the basis of which sick leave is calculated in 2016, is 1,772.6 rubles.[(RUB 624,000 + RUB 670,000) : 730 days]. Let us remind you that the same maximum applies to maternity and child benefits. Compare the average daily earnings that you actually calculated with the minimum. It is determined based on the minimum wage (6204 in 2016) in the manner prescribed in paragraph 15(3) of Regulation No. 375. The minimum average daily earnings for accrual of sick leave benefits in 2016 is 203.97 rubles.(RUB 6,204 × 24 months: 730 days). Comparing the actual average daily earnings and the minimum amount, assign the larger amount for payment. Once the average daily earnings are established, determine the amount of the benefit itself. Do not forget that it also depends on the employee’s insurance experience (Article 7 of Law No. 255-FZ). The formula for calculating sick leave in 2016 will be as follows:

The maternity benefit in 2016 is calculated taking into account the new maximum amounts. Calculation of maternity benefits in 2016 is based on the employee’s income for 2014 and 2015. In the article we will also tell you who is entitled to maternity benefits in 2016. The procedure for calculating maternity benefits in 2016 is established by Federal Law No. 255-FZ dated December 29, 2006. In 2016, the same procedure applies. However, some indicators that are involved in calculating maternity benefits in 2016 have changed. Who is paid maternity benefits in 2016One of the documents required to assign maternity benefits is a certificate of incapacity for work. The doctor writes out a certificate of incapacity for work for pregnancy and childbirth:

Calculation of maternity benefits in 2016The algorithm for calculating maternity benefits in 2016 is as follows. Step 1. We determine the years of the billing period and the amount of payments taken into account (Parts 1, 2 and 3.2 of Article 14 of Law No. 255-FZ). In 2016, the calculation period includes 2014 and 2015. Step 2. We calculate the number of calendar days taken into account in the billing period - we subtract the excluded days from the total number of calendar days in the billing period. Step 3. We calculate the average daily earnings - divide the amount of payments taken into account (step 1 indicator) by the number of calendar days taken into account (step 2 indicator). Step 4. We calculate the maximum amount of average daily earnings - divide the sum of the maximum values of the base for calculating insurance contributions to the Federal Social Insurance Fund of the Russian Federation for each year of the billing period by 730. Step 5. We compare the average daily earnings (step 3 indicator) with the maximum average daily earnings (step 4 indicator) and select the lower value. Step 6. We determine the amount of the daily allowance - multiply the average daily earnings (step 5 indicator) by 100%. Step 7. We calculate the amount of maternity benefits - we multiply the amount of the daily benefit by the number of calendar days falling during the period of maternity leave. An example of calculating maternity benefits in 2016The employee goes on maternity leave in February 2016. It did not replace the years of the billing period. The amount of payments accrued to the employee in the billing period was:

During the billing period, the employee took sick leave several times. The total number of calendar days of her temporary disability was 131. The employee also went on vacation twice - for a total of 56 calendar days. We will use an algorithm to calculate benefits. Step 1. In our case, the calculation period is 2014 and 2015. The amount of payments taken into account was RUB 1,200,000. (570,000 rub. + 630,000 rub.). Step 2. Let's determine the number of calendar days taken into account. It is equal to 600 calendars. days (365 calendar days (for 2014) + 365 calendar days (for 2015) - 131 calendar days (temporary disability)). We do not exclude the number of days of the next paid vacation. Step 3. Let's calculate the average daily earnings. It will be 2000 rubles. (RUB 1,200,000: 600 calendar days). Step 4. Let's calculate the maximum amount of average daily earnings. It is equal to 1,772.6 rubles. [(RUB 670,000 + RUB 624,000) : 730]. Step 5. Let's compare the two quantities. The maximum amount of daily earnings turned out to be less than the amount of actual daily earnings (1,772.6 rubles.< 2000 руб.). В соответствии с новой редакцией части 3.3 статьи 14 Закона № 255-ФЗ дальнейший расчет производим исходя из суммы 1 772,6 руб. Step 6. The daily allowance is 1,772.6 rubles. (RUB 1,772.6 × 100%). Step 7. Let's determine the total amount of maternity benefits. It will be equal to 248,164 rubles. (RUB 1,772.6 × 140 calendar days). How to pay funeral benefits in 2016The employer pays funeral benefits at the expense of the Social Insurance Fund only (Article 10 of the Federal Law of January 12, 1996 No. 8-FZ):

In other cases, individuals apply for funeral benefits to their Social Security Fund at their place of residence. To receive benefits, the employee must provide: 1) an application in any form for payment of benefits; 2) the original death certificate issued by the civil registry office (clause 84 of the Methodological Instructions, approved by the FSS Resolution No. 81 dated 04/07/2008); 3) documents confirming payment for burial services included in the guaranteed list (clause 5 of Article 9, clause 1 of Article 10 of Law No. 8-FZ). For example, CCP or BSO checks issued by the funeral service that provided these services. An external part-time worker is paid a funeral benefit only if it was not paid at the main place of work of the part-time worker (Article 287 of the Labor Code of the Russian Federation, Article 2 of Law No. 255-FZ, Clause 2 of Article 10 of Law No. 8-FZ). The funeral benefit at the expense of the Social Insurance Fund is paid in the lesser of the following amounts (Clause 1, Article 10 of Law No. 8-FZ):

The maximum benefit amount is indexed annually. In 2016 it is 5277.27 rubles. This amount can be adjusted by decree of the Government of the Russian Federation. In districts and localities where regional coefficients are established, the maximum benefit amount must be increased by the corresponding coefficient. The benefit must be paid on the day when the person who applied for it has submitted all the documents necessary to receive it (Clause 2, Article 10 of Law No. 8-FZ). Catherine She was registered in the early stages of pregnancy on November 25, 2015, and received a certificate on May 6. Please tell me, what amount of benefits is accrued (before February 1 or after February 1)? By date of certificate Olga Maternity benefits are calculated for 2014 and 2015. And if I didn’t work in 2014, how will my maternity benefits be calculated? |

Previously, it was assumed that, starting in 2016, the length of service thresholds for calculating sick leave would increase every year. As a result, by 2029, in order to receive a hospital benefit of 100%, you would need to have an insurance record of more than 15 years. However, these changes were never adopted. The law on the payment of sick leave in 2016 is the same as before. In this regard, the calculation of sick leave 2016 is carried out according to the old rules, which we will remind you of in the article. In particular, we will tell you how to determine the calculation period for calculating the amount of sick leave benefits, how to calculate the average daily earnings for temporary disability benefits in 2016, and in what order to pay sick leave benefits in 2016.

From this article you will learn:

- how to determine the billing period for calculating the amount of sick leave benefits;

- how to calculate the average daily earnings for temporary disability benefits in 2016;

- in what order should sick leave benefits be paid in 2016?

Don't miss: the main article of the month from a practical expert

What to do if an employee brings in sick leave with errors.

Calculation of sick leave – 2016

Step 1: Determine your billing period

It is two calendar years that precede the year in which the disability occurred (Part 1, Article 14 of Law No. 255-FZ). Thus, if an employee brought you sick leave in 2016, take into account the period from January 1, 2014 to December 31, 2015.

If the employee has not worked for the last two years, the pay period will be the same.

If during the last two years the employee was on maternity leave or child care leave, you can replace one or both years of the billing period with the year or years immediately preceding such leave (letter of the Ministry of Labor dated December 9, 2015 No. 17 -1/OOG-1755, FSS dated November 30, 2015 No. 02-09-11/15-23247). This can only be done to increase the benefit amount.

Step 2. Sum up all payments to the employee for the pay period

Take into account all the employee’s income for which contributions to the Social Insurance Fund were accrued during the billing period, including vacation pay (Part 2 of Article 14 of Law No. 255-FZ). If an employee has worked for another employer over the past two years and this employer made contributions to the Social Insurance Fund, these payments also need to be taken into account. You will find their amount in the earnings certificate or a copy thereof, which is certified by the employer who issued the certificate.

Step 3. Compare the amount of payments for each year with the maximum base for calculating contributions to the Social Insurance Fund

Every year, the Russian Federal Social Insurance Fund sets maximum bases for calculating contributions. So, for 2011 it is 463,000 rubles, for 2012 – 512,000 rubles, for 2014 it is 624,000 rubles, for 2015 – 670,000 rubles, and for 2016 – already 718,000 rubles. Calculation and payment sick leave 2016 should be carried out taking into account these indicators.

The amount of payments that are taken into account when calculating benefits for each year of the billing period should not exceed the maximum base for calculating contributions to the Social Insurance Fund in the corresponding year (Part 3.2 of Article 14 of Law No. 255-FZ).

For example, if in 2014 an employee was accrued payments in the amount of 580,000 rubles, then they are fully accepted for calculation, since this is less than 624,000 rubles. And in 2015, he received payments in the amount of 680,000 rubles. In this case, since this amount is less than 670,000 rubles, then only 670,000 rubles should be taken into account for the calculation.

Step 4. Calculate the average daily earnings using the formula (Part 3 of Article 14 of Law No. 255-FZ)

Average daily earnings = Amount of earnings for the two calendar years preceding the year of illness: 730

Step 5. Calculate the employee’s insurance period

It includes time worked under an employment contract, periods of state civil or municipal service and other activities. The main thing is that during this period the employee is subject to compulsory social insurance for illness.

The insurance period includes the periods (clause 2, 2.1 of the Rules for calculating and confirming the insurance period):

1. Work under an employment contract

2. State civil or municipal service

3. Military or other service, which is provided for by the Law of the Russian Federation of February 12, 1993 No. 4468-1

4. Other activities during which the citizen was subject to compulsory social insurance, including:

- as an entrepreneur (private notary, private detective, private security guard, etc.), a member of a peasant farm, tribal, family community of small-numbered people of the North, lawyer (after January 1, 2003, periods are included in the insurance period if payments for insurance were transferred) ;

- work on a collective farm or production cooperative (after January 1, 2003, periods are included in the insurance period if insurance payments were made);

- execution of powers of a deputy of the State Duma (Federation Council);

- as a clergyman, if social insurance payments were transferred to the budget during these periods;

- work of the convicted person (after January 1, 2003, periods are included in the insurance period if payments for insurance were transferred).

If during the calculation you have an overlap of periods (for example, the period of work under an employment contract coincided with the employee’s entrepreneurial activity), then the length of service must include the period that the employee chooses. Ask him to write a statement about this. It is drawn up in any form, and in it he indicates the selected period.

The insurance period must be calculated in full years and months. Therefore, convert every 30 days into one month, every 12 months into one year. Also add up the resulting remaining days, convert them to months and calculate their total number. If the balance is less than 30 days, then it can be discarded altogether. As a result, you will end up with a certain number of complete years and months. Take them into account when calculating.

Step 6. Determine the percentage of sick leave payment

You will need the insurance period that you determined in the previous step to understand how much sick leave to pay. There can be two situations here.

Situation 1. The employee himself became ill or injured, or he cared for a sick child under 18 years of age who was being treated in a hospital; or a sick leave was issued to care for a sick family member over 18 years of age.

In this case, the general rule applies. With less than five years of experience, sick leave will be paid in the amount of 60% of the average salary, with 5 to 8 years of experience - 80%, with eight years of experience and above - 100% of the average salary.

Employees' insurance period taken into account when calculating sick leave

Situation 2. A child under 18 years of age fell ill and is being treated on an outpatient basis. Then the amount of sick leave is determined as follows.

Step 7. Calculate the number of paid sick days

The number of days is determined based on the period of illness, which is indicated in sick leave. However, remember that you do not need to pay benefits for days when the employee was on vacation at his own expense, study leave, on maternity leave, or did not work due to downtime.

Step 8. Calculate the amount of temporary disability benefits

To do this, use the following formula:

We calculate temporary disability benefits

Temporary disability benefit = Average daily earnings of an employee x Number of days of incapacity for work x Amount of benefit established as a percentage of average earnings

Step 9. Check the total benefit amount

In some cases, when the employee’s insurance experience is less than six months, or when he violated the treatment regimen or was injured while intoxicated, the final amount of the benefit cannot exceed the minimum wage. Therefore, if your case falls under one of the above, compare the resulting amount with the minimum wage. If it is higher, assign a benefit in the amount of the minimum wage.

Payment of sick leave in 2016

Payment of sick leave by the employer in 2016 is carried out in the same manner and volume as before. The employer still pays for the first three days of illness, the rest is paid by the Russian Social Insurance Fund. Moreover, the employer must do this within 10 calendar days from the date the employee submitted sick leave (Part 5 of Article 13, Part 1 of Article 15 of Law No. 255-FZ). Remember that temporary disability benefits are not subject to insurance contributions to the Social Insurance Fund, Pension Fund and Compulsory Medical Insurance Fund.