What is the difference between general customs statistics and special ones? Basis of customs statistics of foreign trade

Discipline "Customs statistics"

Teacher S. L. Stanevich

Reporting form: During final control– exam

- Subject and method of statistics as a science.

The concepts of statistics and accounting are often equated. Various events, facts, phenomena take place in public life, regardless of whether they are regulated or not. Significant economic events are recorded, for example, the movement of goods across the border is registered in the customs declaration. Recording individual facts is called accounting. Depending on the goals achieved, accounting is divided into: 1) operational accounting - registration of facts, which serves as an end in itself and is needed for certain operational needs. 2) accounting - reflects the facts of the movement of material and financial resources and serves to protect property.. 3) statistical accounting - registration of facts in which a record for each individual fact is made not for the sake of this fact itself, but to obtain an idea of the entire set of facts. Statistical accounting is a breeding ground for statistics. Statistics as a science is a system of disciplines that study the patterns of random phenomena and processes. All statistical studies are united by a common subject of research and a single statistical methodology. The subject of statistical research is mass random phenomena and processes. A statistic aggregate is a set of units united by a single quality. Statistics also studies methods for obtaining data characterizing the entire statistical population. Statistics uses statistical methods to identify relationships between phenomena.

- Subject of study and features of statistics of foreign economic relations.

Statistics of foreign economic relations: 1) Customs statistics (there are foreign trade statistics, special customs statistics); 2) statistics of services in foreign economic activity

The subject of observation and study in foreign trade statistics is the foreign trade turnover of the country, i.e. export and import of goods in quantitative and value terms and the geographical focus of exports and imports. Statistics of services in the foreign economic field is an accounting of foreign trade operations, which, due to their specificity, are not reflected in the customs declaration. Statistics of services in the foreign economic field is an accounting of foreign trade operations, which, due to their specific nature, are not reflected in the cargo declaration. Measuring services: transport, design and survey, construction and installation work, warehousing services, communication services, repair of foreign vehicles and equipment. Intangible services: commercial services, services in the field of education, healthcare, waste disposal and sanitation, services for organizing recreation, tourism, cultural and sports events

- Objectives of statistics of foreign economic relations.

Statistics of foreign economic relations is a branch of economic statistics that studies the quantitative side of economic phenomena and processes in connection with their qualitative content. The tasks of statistics of foreign economic relations include:

– development of indicators reflecting international economic relations;

– development of a methodology for comparing economic development indicators of different countries.

Data from statistics of foreign economic relations are used in the development of foreign economic policy and its implementation

- Statistical observation in customs statistics: concept, forms and types.

Statistical observation is the first stage of any statistical research, which is a scientifically organized accounting of facts characterizing the phenomena and processes of social life, organized according to a unified program, and the collection of mass data obtained on the basis of this accounting.

However, not every collection of information is a statistical observation. We can talk about statistical observation only when statistical patterns are studied, i.e. those that manifest themselves only in a mass process, in a large number of units of some aggregate. Consequently, statistical observation must be systematic, massive and systematic.

The essence of the main requirements for statistical observation is:

Completeness of statistical data (completeness of coverage of units of the population being studied, aspects of a particular phenomenon, as well as completeness of coverage over time);

Reliability and accuracy of data;

Their uniformity and comparability.

In statistical practice, two organizational forms of observation are used:

1) reporting is an organizational form in which observation units present information about their activities in the form of regulated forms. The peculiarity of reporting is that it is mandatory, documented and legally confirmed by the signature of the manager;

2) special statistical survey, an example of which is the conduct of population censuses.

- Objects of statistical observation in customs statistics of foreign trade.

The object of observation is a set of socio-economic phenomena and processes that are subject to research, or the exact boundaries within which statistical information will be recorded. When defining the object of observation, it is necessary to accurately indicate the unit of observation. An observation unit is a component of an observation object, which serves as the basis for counting and has characteristics that are subject to registration during observation.

- Objects of statistical observation of service statistics in foreign economic activity.

Statistics of foreign economic relations studies the volume and structure of foreign trade, the composition of exports, international transportation and tourism, develops the balance of payments, evaluates foreign property and examines international competitiveness. With the transition to the system of national accounts, the need arose to use the information offered in primary documents. Therefore, there was a need to generate customs statistics. The subject of observation and study at the customs station of foreign trade is the country’s foreign trade turnover, i.e. export and import of goods in quantitative and value terms and the geographical focus of exports and imports.

- Organization of customs statistics.

The Federal Customs Service of the Russian Federation has a department of customs statistics and analysis. To carry out departmental research:

1) in the statistics of customs payments, this research is carried out by the Main Directorate of Federal Customs Revenue.

2) in the statistics of customs offenses. Department of Customs Investigation and Inquiry.

3) statistics of customs banking control. Directorate of Currency Control.

- History of the formation of foreign trade statistics and customs statistics in the Russian Empire.

18 century! To reflect foreign and domestic trade, accounting books were kept: the Novgorod book, the Astrakhan book - contains records of goods brought to Russia through Astrakhan, the Little Russian book - records through Sevsk, Putivl, Bryansk, by residents of Ukrainian cities. In the shopping center of Moscow in Gostiny Dvor in Kitai-Gorod there was a large Moscow customs office which had a number of departments. The activities of these departments are described in these books. There, statistics of Russian-Ukrainian foreign trade relations provided information on the composition of Ukrainian traders in Moscow, on imports to Kursk, cargo turnover by month and quarter, and on prices for goods in Ukraine. The organization of statistics there was carried out by the commercial board (trade communications, customs affairs, accounting department, accounting department, etc.) In 1811, the commercial board was transformed into the Ministry of Finance, which changed the department of foreign trade. 19th century - a policy was formed there that promoted an increase in customs revenue and a qualitative increase in foreign trade statistics was observed there. In 1893, Russia issued a law on double customs tariffs, according to which goods from countries that did not present favorable conditions for import and transit to Russia were subject to increased duties.

- Foreign trade and customs statistics in the Soviet Union.

VT there.statistics in the USSR.

The basic principles of the functioning of foreign trade statistics under socialism were formulated in 1917-1918 - this concerned issues of local politics and the state monopoly of foreign trade.

Since 1930, the order of additional It has changed and a different procedure has been introduced for the movement of goods across the border - processing was carried out not at customs, but in the department of statistics of the state customs administration; mechanized accounting was introduced. The most difficult issues were the formation of TN; accounting for foreign trade turnover in quantitative and value terms; from January 1, 2034, 1,961 positions were introduced in the Tax Code. The procedure for processing documents and accounting for imported goods, regulating instructions.

The system of accounting for exports and imports was built in accordance with the practice of foreign trade:

– special registration when crossing the border there

– general – counting when crossing the state border.

Post-war period - countries members of the Council for Mutual Economic Assistance used common accounting systems. The following concepts were introduced: special import is the general import of goods received at the local warehouses of a given state, intended for sale abroad.

– total exports – exports of national goods + re-exports

– special export – goods of national origin + goods previously imported, undergone clearance there and declared for domestic consumption.

According to the methodology of the Economic Mutual Assistance Council, the country’s exports also include re-exports: goods imported into the country and then exported for processing; purchased by foreign trade organizations abroad and imported directly into third countries.

- Foreign trade statistics in the context of the transition of the Russian economy to market relations. Resolution No. 3708-1 of October 23, 1992 approved the state program for the transition of the Russian Federation to the accounting and statistics system adopted in individual practice in accordance with the requirements of the development of a market economy. The main goal of this state program was to create conditions for increasing the efficiency of state regulation of social life on the basis of a reliable assessment of the state and possibilities of various forms of ownership and for predicting their development. Ways to achieve this goal were identified: 1) expanding the reflection in the system of statistical indicators of various aspects of socio-economic processes in accordance with international practice.

2) development and integration into a unified statistical system of primary accounting forms for banking and accounting reports.

3) introduction of new methods for processing primary accounting data.

4) clarification of the composition of periodicity indicators, the order of presentation and the form of publication of hundred data.

The state program proposed to carry out work in the following areas:

1) creation of the SNA of the Russian Federation

2) improvement of the information support system

3) creation of a state product cataloging system

4) introduction of a hierarchical product coding system.

- Foreign trade statistics in the context of the transition of the Russian economy to market relations.

Resolution No. 3708-1 of October 23, 1992 approved the state program for the transition of the Russian Federation to the accounting and statistics system accepted in international practice in accordance with the requirements of the development of a market economy. The main goal of this state program was to create conditions for increasing the efficiency of state regulation of social life on the basis of a reliable assessment of the state and possibilities of various forms of property and for predicting their development. Ways to achieve this goal were identified: 1) expanding the reflection in the system of statistical indicators of various aspects of socio-economic processes in accordance with international practice. 2) development and integration into a unified statistical system of primary accounting forms for banking and accounting. And there.honesty. 3) introduction of new methods for processing primary accounting data 4) clarification of the composition of periodicity indicators, the order of presentation and the form of publication of statistical data. The state program proposed to carry out work in the following areas: creation of the SNA of the Russian Federation, improvement of the information support system, creation of a state product cataloging system, introduction of a hierarchical product coding system.

- Legal basis of customs statistics of foreign trade.

The order approved: 1) the document “Basics for organizing the formation and presentation of VT statistics on a regional basis”; 2) output forms for presenting regional statistics; 3) acceptance into operation of a targeted software package - regstat, designed to ensure the automated generation of source data in the interests of regional VT statistics.

The regional statistics data of the VT are presented to the heads of the constituent entities of the Russian Federation at the Federal Customs Service and to the customs office located in the administrative center of the given constituent entity of the federation.

- Basic terms in the methodology of customs statistics of foreign trade.

The methodology of VT statistics there uses the following terms: territory, border, Russian goods, foreign goods, regime.

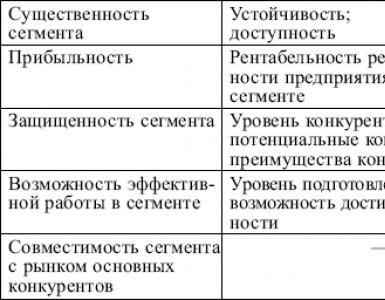

- Export and import accounting systems in customs foreign trade.

In international statistical practice, there are two systems for accounting for export-import transactions: special and general. The differences lie in the definition of accounting measures for these transactions. Under the general accounting system, registration of imports and exports is carried out at the time the goods cross the state border. With a special accounting system - when the goods cross there.border.There.border the boundary of the territory where unified customs legislation is in force. G.t. coincides with the state one if the country does not have free economic zones or free ports.

The general import accounting system takes into account goods brought into the free customs zone at the time of import, even if these goods enter circulation much later. In exports under the general accounting system, goods that were declared for import into free zones, but were subsequently exported, are subject to accounting. The basic principle of accounting for imported and exported goods is determined by the type of procedures there. The RF system there keeps records of the import and export of goods on the basis of a general accounting system, which takes into account the following categories of goods: import - goods imported for free circulation; re-import – goods imported for processing; export – goods exported in accordance with the export regime.

- Object of accounting in customs foreign trade.

The objects of accounting are: 1) goods that should be included in the VT statistics. 2) goods that should be excluded from it (the commodity value of which does not exceed the defect of static observation, currency values in circulation); 3) goods that are accounted for separately (for processing).

- Indicators of customs statistics of foreign trade.

Statistical information on VT contains data on exports of products (quantity and value), imports (quantity, value), foreign trade balance in statistics. Exports and imports calculated in monetary terms are the main economic indicators on the basis of which average prices, trade efficiency, foreign trade balance, the role and place of foreign trade in the country's balance of payments are calculated. To generate customs statistics, the following indicators are used: reporting period, direction of trade turnover, country of origin for import, country of destination for export, statistical value, code for the name of goods, net weight, code and name of an additional unit of measurement, type of customs regime, region. These data make it possible to analyze export-import transactions by category of participants in foreign economic relations. For a more complete analysis, indices of the physical volume of exports and imports, average price indices, and terms of trade index are used.

- Valuation of goods in customs statistics of foreign trade.

To ensure international comparability of export and import values, the UN Statistical Commission recommends valuing goods based on contract prices. The contract price is the market price that exists between exports in one country and imports in another. The valuation of exports and imports depends on the terms of the transaction. To obtain comparable data, it is necessary to bring all prices for goods to a single basis for export and import goods; the basic conditions determine: which party to the transaction bears the costs associated with transporting the goods from the seller - the exporter to the buyer - the importer.

- Calculation of the statistical value of goods in customs statistics of foreign trade.

Methodology for calculating the statistical cost of goods exported from the territory of the Russian Federation: 1) The type of commercial terms of delivery is determined (in column 20 of the customs declaration); 2) if the goods are sold on terms of delivery FOB-ros.port or DAF - border of the Russian Federation, then when calculating statistics, the invoice value (column 42 of the customs declaration) is used, recalculated in US dollars at the Central Bank exchange rate. 3) If the goods are sold under other terms of delivery, then the invoice value should be adjusted to the FOB or DAF price base, and then recalculated in dollars. 4) when adjusting the invoice value, you should take into account which group these commercial terms of delivery belong to.

Methodology for calculating the statistical cost of goods imported into the territory of the Russian Federation: 1) the type of commercial delivery terms is determined; 2) if the goods are sold under the terms of delivery CIF - ros.port or SIP - destination on the border of the Russian Federation, then when calculating the statistical value, the invoice value recalculated in US dollars is used. 3) If the goods are sold under other terms of delivery to the CIF base - ros .port, SIP, and then converted to US$. 4) when adjusting the invoice value, you should take into account in which column “E” “F” and “C” the costs of delivering goods to the place of import are added to the invoice value. The invoice cost excludes the costs of delivering goods to the final destination.

- Quantitative accounting in customs statistics of foreign trade.

It is advisable to carry out quantitative accounting of exports and imports of goods in natural units of measurement in a metric unit of measurement by net weight. If necessary, goods are recorded in additional units of measurement. Accounting is carried out both in terms of value and quantity as of the date of receipt of permission from the customs authority to release goods across the border. The date of import and export of goods arriving via pipeline transport and power lines is considered to be the date of acceptance of the delivery certificate drawn up at the border control distribution point

- Classifiers in customs statistics of foreign trade.

To classify and code goods in VT statistics, the Commodity Nomenclature of Foreign Economic Activity is used. The classifier developed by the UN Bureau of Statistics is used as a classifier of countries in the world. Updating of classifications of countries of the world is carried out on the basis of notifications from the main research center for maintaining all-Russian classifiers of the State Standard of Russia. In addition, in VT statistics, a number of local classifiers are used: a classifier for the procedure for moving goods across the border of the Russian Federation, a classifier for the formation of an identification number for a participant in foreign economic relations, a classifier for supply conditions, a currency classifier, and a transaction classifier.

- Concept, meaning and methods of classification of goods in the Commodity Nomenclature of Foreign Economic Activity.

- Output forms of official publications of customs statistics of foreign trade.

The data contained in the customs declaration becomes a documentjv? The basis for characterizing the country's VT. Brief statistical information on VT is intended for its analysis. The main form of data presentation in statistics is statistical tables. In 1992, in accordance with the implementation of the state program, the output forms of publications were coordinated with the leading economic departments of the country. A little earlier, these forms were approved by international organizations. The order approved 28 output forms of accountability, on the basis of which, starting in 1994, quarterly, annual publications and monthly data on VT statistics are formed.

- Declaration - as a source of initial information in customs statistics of foreign trade.

Declaration is a statement by the declarant in the prescribed form (written, oral, by electronic data transmission or other) to the customs authority of a given country of exact information about goods and vehicles, or transported across its customs border, or the customs regime of which is changing, or in other cases determined acts of national legislation, on their customs regime and other information necessary for customs purposes. In the Russian Federation, goods are declared to the customs authority of the Russian Federation, where their customs clearance is carried out. Vehicles, with the exception of sea, river and aircraft transporting goods, are declared simultaneously with the goods; sea, river and aircraft - at the port or airport of arrival to the customs territory of the Russian Federation or at the port or airport of departure from the customs territory of the Russian Federation, empty vehicles and vehicles carrying passengers - when crossing the customs border of the Russian Federation. The form and procedure for declaration, as well as the list of information required for customs purposes, are determined by the Federal Customs Service of the Russian Federation.

- Commercial conditions for the supply of goods in customs statistics of foreign trade.

Foreign trade purchase and sale transactions are actions of individuals and legal entities from different countries aimed at establishing, changing or terminating civil rights and obligations in the purchase and sale of goods and services in foreign trade. Currently, an updated edition is in force - INCOTERMS-2000. The document provides a detailed interpretation of the main options for the basic terms of the contract in relation to modern methods of transportation for all types of transport and intermodal transport. The short names of the main basic terms of the contract are indicated by the first letters of English words expressing their content.

Main types of payment terms. The contractual legal details of a foreign trade contract that determine the form of sale of goods (cash payment, credit, etc.) are assigned to these varieties.

FAS (from the English Free Alongside Ship) is a type of commercial terms for the supply of goods in international trade. Trading operations under FAS conditions require the seller to bear all costs of delivering the goods to the ship. In this case, the selling price includes the price of the product itself, transportation and other costs until it is loaded on board the vessel.

CIF (from the English Cost, Insurance, Freight) is a type of commercial terms in international trade that establishes the procedure for the delivery and payment of goods.

FOB (from the English Free of Board) - “free on board”, commercial terms of delivery and payment of goods, in which the price of the goods takes into account the duties and responsibilities of the seller (exporter) for the delivery and loading of goods on board the ship. When buying and selling on FOB terms, the selling price includes the price of the product itself, transportation costs for its delivery and loading it on board the vessel. When delivering goods by rail and other modes of transport, FOB acquires the expression “free wagon”.

- Calculation of the price of goods depending on the commercial terms of delivery.

The price of a product is one of the most important elements of a sales contract. Each foreign trade transaction must necessarily contain a condition on the price at which the product is sold, or an indication of the method for determining the price of this product. A common way to determine the price is when it is set at the exchange rate on the day of delivery.

When stipulating the price of a product, the sales contract names: the unit of measurement of the price, the basis of the price, the currency of the price, the method of fixing the price and the price level.

2.1. Unit of price measurement. The procedure for determining the unit of measurement of price depends on the nature of the product and on the practices that have developed in the trade of this product on the world market. The price in the contract can be set:

For a certain quantitative unit (or for a specific number of units) of a product, indicated in units of measurement usually used in the trade of this product (weight, length, area, volume, pieces, sets, etc.), or in counting units (hundred, dozen );

– per weight unit, based on the basic content of the main substance in the product (for goods such as ores, concentrates, chemicals, etc.);

– per weight unit, depending on fluctuations in natural weight, the content of foreign impurities and humidity.

When supplying goods of different quality and assortment, the price is set per unit of each type, grade, brand of goods separately. If a large number of goods with different quality characteristics are supplied under one contract, their prices, as a rule, are indicated in the specifications that form an integral part of the contract.

When supplying complete equipment, prices are usually set item by item for each partial delivery or for individual component parts and are indicated in the annex to the contract.

If the price is based on a weight unit, it is necessary to determine the nature of the weight (gross, net, gross for net) or stipulate whether the price includes the cost of containers and packaging. This indication is also necessary in cases where the price is stated per piece or per set.

2.2. The price basis determines whether transport, insurance, warehouse and other costs for delivery of goods are included in the price of the goods. The price basis is usually determined by using the appropriate terms Ex-enterprise, Ex-carrier, FOB, CAF, CAS, CIF, etc.) indicating the name of the point of delivery of the goods. For example, the contract states: “The price is $100 ex-wagon border border station Chop of the seller’s country.”

- Index method in customs statistics of foreign trade.

The index method is widely used in trade statistics. Depending on the nature of the phenomenon being studied, indices of volume and quality indicators are calculated here. Volume indexes characterize changes in the volume of receipts and sales of goods, the level of inventory, etc. Indices of quality indicators characterize changes in prices, labor productivity, distribution costs, profits and other indicators.

A statistical index is a relative value for comparing complex populations and their individual units. In this case, complex is understood as such a statistical set, the individual elements of which are not directly subject to summation.

For example, the assortment of food products consists of commercial varieties, the primary accounting of which in production and wholesale trade is carried out in natural units of measurement: milk - in liters, meat - in centners, eggs - in pieces, canned food - in conventional cans, etc. To determine the total volume of production and sales of food products, it is impossible to summarize the accounting data of heterogeneous commodity masses in natural units of measurement. Data on the quantity of produced and sold non-food products of various types are also not subject to direct summation. It would, for example, be pointless to summarize data on the sale of fabrics (in meters), suits (in pieces), shoes (in pairs), etc., to obtain the total sales volume.

In these complex statistical aggregates, the units of observation are goods with different consumer properties. Data on the physical form of sales of individual product varieties are not subject to direct summation. To obtain generalizing (total) values in complex statistical populations, they resort to the index method.

The basis of the index method in determining changes in the production and circulation of goods is the transition from the natural-material form of expression of commodity masses to cost (monetary) measures. It is through the monetary expression of the value of individual goods that their incomparability as use values is eliminated and unity is achieved.

- Automated system for maintaining customs statistics of foreign trade.

Unified automated information system of the State Customs Committee of the Russian Federation– The central information repository of the department and the regional nodes of the Unified Automated Information System (UAIS) of the State Customs Committee of Russia are implemented on the industrial Oracle DBMS. The use of a single DBMS as a target platform is an important positive point in the recent work on modernization and unification of customs databases. At the same time, the Oracle 9i DBMS uses not only the traditional functions of the relational core, but also new capabilities, such as, for example, support for storing and operations with XML documents, which occupy an increasingly large share in the internal information exchange of customs.

Decision support system (DSS) “Analytics” effectively solves the problems of operational multidimensional analysis of aggregated data of the UAIS State Customs Committee of Russia, providing a new level of data analysis and performance indicators that are incomparable in comparison with traditional statistical analysis. The complex is characterized by functional completeness, a successful architectural solution, high performance and, most importantly, demand from users.

In the process of developing and optimizing the system, it was possible to significantly increase the efficiency of working with data from the State Customs Committee of Russia, reducing the time it takes to load information and the amount of memory required to store aggregated data. The time it takes to execute ad hoc queries on customs declaration data has been reduced from hours and days to seconds and minutes.

The UAIS database of the State Customs Committee of Russia stores historical data on customs declarations starting from 1996. The daily receipt of data on electronic copies of cargo customs declarations (CCD) and customs receipt orders (CRO) ranges from 6 to 8 thousand records. The growth rate of database volume is on average about 600 thousand records per quarter. This data array, numbering more than 25 million documents and more than 120 gigabytes of data at the beginning of 2003, contains the most valuable information about Russia's foreign economic activities.

Information customs technology for the preparation and generation of publications of customs statistics of foreign trade - the ITT System “Publication-TSVT” implements one of the most important functions of the Department of Customs Statistics and Analysis (UTSA) of the State Customs Committee of Russia - the preparation of publications of foreign trade statistics. As a result of the project, the efficiency of preparing quarterly bulletins and annual collections on customs statistics of foreign trade of Russia, the Union of Belarus and Russia has decreased, the productivity of specialists involved in this process has increased, the number of routine data control operations has decreased, and the degree of reliability of published data has increased.

The new technology has been in operation since the end of 2002 and has already demonstrated its effectiveness. Thanks to the use of developed tools for generating regulated reports and the ability to conduct multidimensional operational data analysis, the quality of information, the efficiency of its processing and registration in the form of official publications of customs statistics of foreign trade have significantly increased.

Automated system of access to data on customs statistics of foreign trade– The automated system for accessing data on customs statistics of foreign trade (ASD “Access-TSVT”) provides access to subscribers of Internet/Intranet networks to information arrays of customs statistics of foreign trade (IM TSVT) of Russia specially created for these purposes, and provides services (tools) for operational analysis of aggregated data of customs statistics of foreign trade. The project makes it possible to expand the circle of potential consumers of TCVT data, improve the efficiency and quality of data dissemination by providing users of the Internet/Intranet environment with both TCVT information itself and developed tools for multidimensional operational analysis of aggregated TCVT data.

Automated system for the exchange of information resources with the customs services of the countries of the Commonwealth of Independent States - The Automated System for the Exchange of Information Resources (ASOIR) in the Unified Information Space of Customs Services (UITS) of the CIS is being created to increase the efficiency of interaction between customs services. It is designed to ensure prompt coordination of decisions made by the customs authorities of the states participating in the information exchange by increasing the efficiency of using geographically distributed information.

The system must ensure automated data exchange through a heterogeneous transport environment between subscribers according to agreed indicators, formats, structures and protocols, as well as automation of decision support based on the analysis of data obtained as a result of information exchange. Standardization and unification of information exchange is achieved through the use of unified reference information (UNSI) for encoding information indicators and uniform standards for describing electronic messages based on XML.

- The purpose, objectives and object of studying statistics of customs payments.

The legal basis for maintaining statistics of customs payments is the Customs Code of the Russian Federation and the Law of the Russian Federation on customs tariffs. The objects of study of statistics of customs payments are duties, taxes and fees, the collection of which is entrusted to the customs authorities. The purpose of statistics on customs payments is to provide the leadership of the Federal Customs Service of Russia, the executive and legislative bodies of the country with information on the receipt of customs payments to federal bodies. Objectives of statistics on customs payments: collection and systematization of data on the calculation, collection and receipt of customs payments; information support for monitoring the correctness of calculation, collection and receipt of TP; analysis of TP by type in the context of product range and geographic direction of commodity flows; analysis of the dynamics of TP receipt; identification of systemic and external factors in relation to the customs system that influence the receipt of customs payments to the federal budget.

- Organization of statistics of customs payments.

Maintaining a hundred and there payments is assigned to there. Bodies of the Labor Code of the Russian Federation, Article 213. The purpose of maintaining the status is there. Payments are the provision of information to the management of the State Customs Committee, the Ministry of Finance and other public structures with data on the implementation of fiscal functions there. Organs. The object of study is one hundred and there. Payments are all payments of taxes and fees, the collection of which is entrusted to there. Organs. To the main tasks of maintaining statistics and there. Payments: 1) accounting and control of accrual, collection and receipts to accounts there. The organs are there. Payments received from participants in foreign trade activities; 2) accounting and control of receipts there. Federated payments Budget; 3) systematization of information on accrual, collection and receipt by the federation. The budget is there. Payments by their types, by currency in which they are paid separately in trade and non-trade turnover. The most important analytical task is there. payments is the justification of planned targets. To solve this problem, it is necessary to take into account: 1) volumes of commodity flows and their structure by goods and countries, 2) personnel composition of customs officers, 3) domestic and foreign market conditions, 4) dynamics of information and the dollar exchange rate, 5) foreign trade there. state policy.

Maintaining statistic payments is covered by org st. 290 of the Labor Code. The main purpose of statistic payments is to provide the management of the State Customs Committee and authorities with data on the receipt of customs payments in the FB. Accordingly, the tasks of customs statistics are 1 collection of information on the calculation, collection and accrual of fees there in the FB 2 analysis fulfillment of control tasks on customs payments 3 determination of the share of customs payments in the FB 4 analysis of payments there by their types of goods, customs authorities, the objects of study of the statistics of customs payments are all payments, taxes and fees, the collection of which is entrusted to the customs authorities.

Statistics of customs payments: system of primary indicators and characteristics, statistical reporting forms.

- calculation of customs duties.

1) at an ad valorem rate

S p =T s *P/100%

T with customs value

P customs duty rate in %

2) at a specific rate

S p = B t * P s * euro exchange rate

- Calculation of value added tax.

This type of tax in the Russian Federation came into force on January 1, 1992 as a result of tax reform on the recommendations of a number of foreign countries.

VAT belongs to the group of indirect taxes and is a regulating federal tax. VAT in full goes to the federal budget and on average forms 13.8% of budget revenues.

The Federal Budget Law does not establish the proportions for the distribution of VAT between the federal and regional budgets, however, a certain part of the VAT is allocated to regional budgets when funds are allocated from the federal budget to constituent entities of the Russian Federation in the form of subsidies, subventions, transfers, and other financial assistance.

VAT is a form of withdrawal to the budget of part of the added value created at all stages of production and circulation and is defined as the difference between the cost of goods (work, services) sold and the cost of material costs attributed to the costs of production and circulation. The tax is universal in nature, since it is levied on all goods and services throughout the entire production cycle from the manufacturing plant to the place of sale. Moreover, each intermediate participant in the process pays tax. Value added is the part of the cost of goods, works and services that is created by labor and includes wages and profits.

It is legally determined that the amount of value added tax subject to contribution to the budget is determined as the difference between the amounts received from buyers for goods (works and services) sold and the amounts actually paid by suppliers for material resources (works, services), the cost of which refers to production and distribution costs.

VAT payers are tax subjects (Russian and foreign legal entities) carrying out production and other commercial activities, as well as individual private entrepreneurs forming a legal entity. In particular, tax payers are: all enterprises and organizations, regardless of their form of ownership and departmental affiliation, having the status of a legal entity; non-profit and other organizations.

Individuals engaged in entrepreneurial activities without forming a legal entity are not tax payers.

Organizations and individual entrepreneurs are exempt from VAT if, over the three previous consecutive calendar months, the amount of revenue from the sale of goods (work, services) of these organizations or individual entrepreneurs, excluding tax, did not exceed a total of two million rubles.

Persons exercising the right to exemption must submit the appropriate written notification and documents specified in paragraph 6 of Art. 145 of the Tax Code of the Russian Federation.

The amount of tax for the month in which there was an excess or in which excisable goods and (or) excisable mineral raw materials were sold is subject to restoration and payment to the budget in the prescribed manner.

- Calculation of excise duty.

- Excise tax amount for excisable goods(including when imported into the territory of the Russian Federation), in respect of which fixed (specific) tax rates, is calculated as the product of the corresponding tax rate and the tax base, calculated in accordance with Articles 187-191 of the Tax Code.

2. The amount of excise duty on excisable goods (including those imported into the territory of the Russian Federation), in respect of which ad valorem (in percentage) tax rates are established, is calculated as the percentage share of the tax base corresponding to the tax rate, determined in accordance with Article 187-191 of the Tax Code. code.

3. The amount of excise duty on excisable goods (including those imported into the territory of the Russian Federation), in respect of which combined tax rates have been established (consisting of fixed (specific) and ad valorem (percentage) tax rates), is calculated as the amount obtained as a result of addition excise tax amounts calculated as the product of a fixed (specific) tax rate and the volume of sold (transferred, imported) excisable goods in kind and as a percentage of the maximum retail price of such goods corresponding to the ad valorem (in percentage) tax rate.

4. The total amount of excise tax when carrying out transactions with excisable goods recognized as an object of taxation in accordance with this chapter is the amount obtained by adding up the amounts of excise tax calculated in accordance with paragraphs 1 and 2 of Article 194 of the Tax Code for each type of excise tax. goods subject to excise duty at different tax rates. The total amount of excise tax when carrying out transactions with excisable petroleum products recognized in accordance with this chapter as an object of taxation is determined separately from the amount of excise tax on other excisable goods.

5. The amount of excise duty on excisable goods is calculated based on the results of each tax period in relation to all transactions for the sale of excisable goods, the date of sale (transfer) of which relates to the corresponding tax period, as well as taking into account all changes that increase or decrease the tax base in the corresponding tax period .

6. The amount of excise duty when importing several types of excisable goods into the territory of the Russian Federation, subject to excise duty at different tax rates, is the amount obtained by adding up the amounts of excise duty calculated for each type of these goods in accordance with paragraphs 1-3 of Article 194 Tax Code.

7. If the taxpayer does not keep separate records provided for in paragraph 1 of Article 190 of the Tax Code, the amount of excise duty on excisable goods is determined based on the maximum tax rate applied by the taxpayer from the single tax base determined for all excise-taxable transactions.

1) at an ad valorem rate

C excise tax = (T s + C p) + A/100%

T with customs value

P s customs duty rate per unit of goods

2) at a specific rate

C excise tax =(V t * A) +((T s + C p) * A)/100%

In t quantity of goods in physical terms – weight

T with customs value

- Statistical indicators and signs in the statistics of customs payments.

The object of statistic customs payments is taxes, duties and fees, collection

Monitoring the status of payments there has a documentary basis - the main primary document is the customs declaration, as well as payment documents. the system of primary indicators includes basic and additional indicators. The main indicators include: 1 amount of accrued payments; 2 sums of collected payments; 3 sums of received payments. Additional indicators include deferments and installments, benefits, funds in transit, advance payments. Attributive characteristics include types of payments, taxes and fees, direction of commodity flows, units and product groups, participants in foreign trade activities, customs authorities.

The form of statistical reporting on customs payments, as well as in other areas of special customs statistics, is determined by the annual order of 2002 No. 999 Forms 4-pl (for fees) and 5-pl (for types of fees) Section II. Statistic reporting of foreign trade 28.04. 94 No. 180

In the system of primary indicators, we can distinguish between main and additional indicators. The main indicators include: 1) the amount of accrued payments, 2) the amount of collected payments, 3) the amount of received payments. Additional indicators include: 1) advance payments, 2) deferments and installments, 3) exemptions and benefits, 4) funds on the way. To the attributive characteristics by which we can build groupings in the article there. Payments include: 1) types of payments, 2) trading\non-trading. Turnover, 3) currency, 4) modes

Inform. Base and forms of statistics. Reporting:

Observation in the article there. Payments are made on a documentary basis. The primary document is the customs declaration. The main cost indicator by which accrual is carried out there. payments is there.cost.

Information base – primary documents:

1. Customs declaration, 2. payment documents (payment orders); 3. control documents; 4. bank information (statements and payment documents from the bank where the customs account is opened). CCD is a comprehensive information base for technological process statistics. The customs declaration is a complex accounting and statistical document that reflects in its columns the details of the foreign trade operation being carried out. CCD columns are accounting registers containing various statistics. Special columns concern customs duties. Gr. 47 “Calculation of duties and fees there” is a special table that shows the accrual of payments there. Consists of 5 columns: “type” (the two-digit digital code of the TP is indicated; “accrual basis”; “rate” – the size of the payment rate; “amount” – the amount due for payment; “SP” – payment method, u/ n, or deferment, installment plan). Information 47 gr. Allows you to maintain TP statistics regarding accrued monetary amounts. By grouping the content of the customs declaration into arrays by time periods, it is possible to study the dynamics of accrued TP, their structure, and identify the range of priority items for taxation of TP

Sta-ah there. payments to date Vr. It is practically the only direction in the station where, in addition to reporting data, planned indicators or control tasks appear. Control tasks are determined for the State Customs Committee of the Government, and the State Customs Committee already distributes it to the RTU, and the RTU to customs offices. For the reporting period, information is presented as admission there. payments, and about the compliance of receipts there. payments and planned tasks. The statistics are there. payments are not provided in open publications; used for official use and provided in statistical forms. Reporting regulated by an annual order. At present. Presentation time next. Reporting forms: 5-PL section 5 – by type there. Payments; 4-PL - section 5 - by type there. Fees; 10-“customs regimes” (payments) – section 1; for vehicle adjustments - form 2 -TST section 1 -on vehicle adjustments with changes there. Payments.

- Forms of statistical reporting on customs payments.

- Control over the correctness of calculation and collection of customs duties.

- Customs declaration - as a source of information on statistics of customs payments.

The customs declaration is a complex accounting and statistical document that reflects in its columns the details of foreign trade operations. By grouping customs declarations into arrays by time periods, customs specialists have the opportunity to: study the dynamics of payments accrued there; identify their structure; identify the range of goods that are priority for the state in terms of accrual of payments there

- Customs declaration - as a tool for accounting and control of customs payments.

Accounting for funds received into customs accounts accrued and collected under the customs declaration is carried out by the customs departments. The system for accounting for payments therein includes the following components: control over the correctness of their accrual; maintaining customs bank accounts; ensuring timely and complete transfer of payments from the customs account to the FCS account; control over the completeness of receipt of payments to the FCS accounts; compilation of reliable reporting on funds in customs accounts. Gas turbine engines are formed at the site of the fores

- Mechanism and technology for generating statistics of customs payments.

- Economic and statistical methods for analyzing the export of goods in relation to macroeconomic indicators.

With all the variety of methods used for statistical analysis and forecasting of foreign trade, experts divide them into 3 main groups:

- expert assessments;

- logical and mathematical modeling.

The processes being studied in the field of foreign trade are developing in close connection with the economic and political situation in the country. Therefore, foreign trade indicators are difficult to analyze without taking into account the country’s economic development and economic policy.

A comprehensive analysis of the direction of development of foreign trade is characterized by a whole set of indicators. Foreign trade is characterized by the economic policy of a particular country and the influence of economic factors on it.

X – export size;

Px – prices of export products;

Py – internal prices;

γ – production capacity;

GAP – excess domestic demand.

This means that the volume of exports is affected by:

- volume of production;

– price factor.

For example, exports of mining products depend on the volume of production and domestic consumption, as well as on the level of world prices and on the foreign economic regime of the country. Manufacturing exports depend on competitiveness. In the context of a decline in production in some countries, due to the narrowness of the domestic market, exports do not decrease, but even increase.

Import demand equation:

M – cost;

Рm – price.

- Economic and statistical analysis of factors. Influencing changes in imports of goods.

Analysis and forecasting of imports of goods is of great importance:

– imports provide the main income to the Federal budget;

– competition caused by the supply of imported goods contributes to the development of domestic products;

– import is a necessary condition for international exchange.

Import demand equation:

M – cost;

Рm – price.

The volume of imports increases with an increase in the variable - real income of the population. The price competitiveness variable reflects the response of import volumes to changes in relative prices and changes in exchange rates.

If the dollar falls, import prices fall according to IMF models.

The main economic factors determining the volume of imports are:

– domestic income or real gross domestic product;

– price, expressed as the ratio of domestic import prices for imported goods.

- Statistical methods for assessing the influence of economic factors on the formation of foreign trade.

- Goals, objectives and objects of studying currency control statistics.

- Statistical reporting form for foreign exchange control. Form 18 - “Control”.

F-18 “control” – “Information on the results of currency control over transactions carried out there. authorities."

This reporting is monthly, compiled on an accrual basis, and is in electronic format.

Part 1: indicators

1) detection of violations

2) initiation of a case of administrative offenses (quantity, cost in US dollars)

3) the amount of accumulated fines

4) the amount of fines collected

2nd part:

1) number of cases of violations according to cat. information was transmitted to the tax authorities, authorities of the Ministry of Military District of the Russian Federation, min. Finance, prosecutor's office, etc.

2) the amount of violations, information and cat. transferred

- Statistical reporting forms for currency control. Form 21 - “Loan”, 1 - “Shaft”.

F -21 – “Loan” – information about goods imported under contracts concluded on account of loans from the International Bank for Development and Reconstruction – monthly, in electronic format, on a non-accrual basis.

Indicators: loan number, name of importer; No. of foreign trade contract; contract date; No. GTD; invoice cost of goods; contract currency code.

F – 1 – “Val” – information on the import and export of foreign currency to individuals – monthly, on a non-accrual basis, in electronic format. Data sources are passenger customs declarations TD-6.

When entering data, indicate: details of the individual; direction of currency movement; import/export country code; currency code; number of currencies; date there.of registration; code of the local authority performing maintenance

- Main functions and organization of maintaining statistics of customs offenses.

The main functions of the station are there. offenses:

1) development of reporting forms

2) work on filling out reporting forms

3) obtaining summary data for the corresponding period

4) data reconciliation by logical control and calculation of checksums

5) analysis of summary data

for better organization there. Hundreds of offenses must be observed

- efficiency of collection, processing and storage of data on cases there. Offenses

The ability to automate the processes of creating and maintaining both main and additional databases to provide information support for law enforcement work

- efficiency of using the entire volume of special data there. St-ki

-use of data in near real time

- The main goals and objectives of statistics of customs offenses.

Purpose: providing leadership there. Bodies on the state of law enforcement activities to make decisions to improve its organizational and legal foundations.

Tasks:

- information support for law enforcement activities

- accumulation, processing, generalization and analysis of data on law enforcement activities

- studying the dynamics of manifestation of illegal acts

- studying the relationship between indicators there. Pravonar. And foreign trade activities

- development of methodology and practice of using data from the system in operational and official activities

- information support for the preparation of effective management decisions to combat there. Pravonar.

- formation of a system of generalizing statistics. Law enforcement indicators

- assessment of activities there. Law enforcement agencies.

- Subject and object of statistical observation in customs crime statistics.

The subject is mass random phenomena, united by the sphere of competence there. Bodies as law enforcement structures of the state.

The object of the study is crimes in the area there. Affairs; violation there. Rules; administrative violations.

- System of signs and indicators in statistics of customs offenses.

Signs and indicators

Attributive and quantitative characteristics and indicators

Attributive: 1) qualification of cases + violation there. Rules

2) subject of the offense

3) object of the offense

4) primary documents

Quantitative characteristics, measurable properties of the process being studied, are presented in the form of statistics. Indicators

1) primary number of cases opened; amount of sanctions

2) production relative indicators, average; indicators of variation, dynamics

- Forms and types of statistical observation in statistics of customs offenses.

Stat. observation is the collection of primary information by recording facts in a special accounting document.

There. The offense may take the form of a violation case there. rules, the act of imposing a penalty in a simplified form of a criminal case.

Program and methodological issues of statistical observation are being developed:

1) object of observation and units

2) forms and types of observation

3) list of signs

Stat forms observations:

– reporting (permanently organized report)

- special Organized observation (responses to one-time requests)

Types of observation:

1st in terms of coverage:

-solid

- not continuous

2nd by registration time

-current

-periodic

-one-time

- Statistical reporting in the statistics of customs offenses.

Recording of offenses and reporting

Registration of offenses is carried out on the basis of primary documents. The accounting of scientific and technical progress is kept in the accounting journal, its filling is regulated by the appropriate methodology. The journal reflects data (about 15 details) about it. Offenses. The journal is kept in paper form. The summary and grouping of data contained in the journal is used to compile statistics. Reports. Stat. reporting there. Offenses (about Art. Labor Code) are regulated by the annual order of the State Customs Committee. Reporting forms: 1-NTP - main (it contains data on offenses grouped: 1) by articles of the Labor Code, 2) by subjects of the offense, 3) by goods ,4) by stage of consideration of cases, 5) by direction (import/export) - indicating the number of cases and sanctions imposed (fines, confiscations, recovery of costs), 2-NTP (information about materials attached to cases of NTP), 3-NTP - information about cases of NTP we are under control and in production), 4-NTP- (information about the execution of decisions on the imposition of penalties in the form of a fine, the cost of goods, etc. Wed, and about reimbursement of costs about cases about NTP), 5-NTP (report on the repayment of debt on fines, collection of the cost of goods and other services, costs in cases of NTP), 6-NTP (information on cases of NTP in relation to goods classified in commodity positions 2709 and 2710) ,7-NTP (information on suppression of illegal trafficking of ethyl alcohol, alcoholic and tobacco products), 8-NTP.

Basic summaries and groupings of those offenses containing signs of a crime, their reflection in the statistical forms. Reporting. The accounting of crimes in this area is carried out in accordance with the joint instructions of the General. The Prosecutor's Office and the Ministry of Internal Affairs of the Russian Federation “on a unified record of crimes” dated December 14, 1994 and in accordance with the instructions of the department for combating there. Law of the State Customs Code of the Russian Federation dated 01/08/98 “on reporting on the work of investigation units.” In accordance with these documents, for each offense with the sign of a crime, several cards are created: - for identified crimes; - about the results of the investigation of a crime; - for crimes based on by which a person has been identified; - a person has committed a crime; - a person suspected of committing a crime; - the progress of a criminal case; - the results of compensation for mat. Damage; - about the results of consideration of mat. Damage. Based on the account. Cards filled out 2 forms stat. reporting: 1) 14-proc-oration angle. Things to do there. Pravonaru-yam, 2)15-prok – about case materials with signs there. Crimes. Both of these forms are filled out monthly in 4 copies: 1st copy. – to the inquiry department of the RTU; 2nd copy. – to the accounting department of RTU; 3rd copy. - to the prosecutor's office, respectively. District, 4th copy. - to the inquiry department at customs. Form 14-prok contains the following. Information: 1) on the number of cases under Art. 188, 189, 190, 194 of the Criminal Code, 2) information on cases under Art. 194 of the Criminal Code, 3) information on the number of persons detained on suspicion of committing a crime, 4) information on the angle. Cases submitted to the investigative authorities or the prosecutor's office, 5) information on criminal cases initiated regarding commercial goods, 6) information on possible criminal cases. Cases without a breakdown by article, 7) information on the number of seized cultural and historical values by area of interest. Cases, 8) information on measures to ensure possible confiscation during the inquiry process. Form 15-prok provides information on cases broken down by Art. Criminal Code, in relation to the cats, a decision was made to send them to the investigative authorities, the prosecutor's office and other customs authorities.

- Features of regional customs statistics.

History of customs statistics

Customs statistics of Russian foreign trade have a rather long development path. It is impossible to unambiguously determine the date of its origin, but in 1693-1694. The first customs books were created, which give a complete and detailed picture of foreign and domestic trade at the end of the 17th century.

Modern customs statistics are part of customs affairs in the Russian Federation (RF), studying and analyzing the quantitative side of phenomena and processes that occur in foreign trade.

Some of the main areas of customs statistics are: operational accounting of customs payments, combating smuggling, currency control, non-trade turnover and tracking violations in the field of customs rules.

Note 1

Customs statistics of foreign trade activities is an important component of the general statistics of Russia.

Objectives and goals of customs statistics

Note 2

The main task of customs statistics is to provide information on how the country’s foreign economic activity is developing. The objects of its accounting are goods and services that make up the country's exports and imports.

The statistics of foreign economic relations include:

- customs statistics,

- service statistics.

In turn, customs statistics are divided into:

- customs statistics of foreign economic relations,

- special customs statistics.

The subject of the study of customs statistics is statistics of foreign trade, foreign trade turnover in the country, the quantitative ratio of exports and imports in the country in value terms, including the study of the geography of exports and imports. In other words, customs statistics examine countries of export and import, including possible potential countries. Studying the economic components of other countries can help determine the potential for further cooperation and interaction.

Based on customs statistics, countries are identified whose ties have an adverse effect on the economic state of the country. Therefore, in the future, based on the analysis of customs statistics, such ties are broken or sanctions are imposed.

Customs control authorities collect and process information about goods moved across the customs border, and publish customs statistics data to provide the highest authorities with the necessary information about the state of Russia's foreign trade, its trade and balance of payments.

Customs statistics are characterized by their own goals that correspond to the assigned tasks. The objectives of customs statistics are:

- control of revenues to the federal budget from customs duties and taxes,

- providing supreme authorities and other government bodies with the necessary statistical information on the state of foreign trade of the Russian Federation,

- generation of a report and analysis of the state of the Russian Federation, its balance of payments and the economy as a whole.

Objects of observation are analyzed in customs statistics. The objects of observation in customs statistics are understood as export and import goods that the importer or exporter indicates in the Commodity Nomenclature of Foreign Economic Activity, used when declaring goods under a particular customs regime.

The main activity of customs statistics is the analysis of incoming data from customs authorities. In addition to the main activities, the scope of customs statistics includes secondary activities. Customs statistics specialists keep records of the following data:

- information about imported and exported non-monetary gold, silver and other precious metals that I do not act as a means of payment,

- information on the import and export of securities, banknotes that are not in circulation,

- accounting for goods that are provided to UN technical support funds or free of charge as gifts or other assistance,

- accounting for sold and purchased bunker fuel, and other food materials for domestic ships, aircraft and cargo transport,

- accounting for goods that are rented for a period of more than one year at full cost, if the calculation is at full cost at the time of import or export of the goods.

Objects for observation are determined by the State Customs Committee. The objects of customs statistics include goods subject to statistical observation and accounting. In addition, this committee determines the procedure and methods for accounting for partner countries with which interaction occurs on issues of import and export. Committee specialists determine the threshold for statistical observation and prescribe a list of mandatory indicators that are taken into account in customs statistics.

Methods for recording customs statistics

The most accurate method in customs statistics is the quantitative method, which most fully reflects the volume of international trade turnover. Quantitative accounting is carried out by net weight.

Definition 1

Net weight is the net weight of the product, which is taken into account without external and internal packaging.

In addition, the statistical evaluation is influenced by the cost estimate. Statistical observations are made on the basis of goods imported and exported from the territory of the state; the customs declaration, which indicates detailed information about the goods, is analyzed.

The uniqueness of collecting statistical data lies in the fact that when filling out a declaration, digital codes are used, which allow you to automate data recording. Goods are accounted for by the country from which they were delivered. If during the process of exporting or importing the country it was not possible to determine the country, then exports are reflected by the country of sale, imports by the country of purchase, respectively.

Definition 2

The country of sale or purchase is understood as the territory where the organization or company that carried out the sale or purchase of the goods is actually located, regardless of its nationality.

Customs statistics are a very important component for any country. The correct work of this government body allows us to further analyze the country’s foreign economic activity.

CUSTOMS STATISTICS - statistics based on customs registration of import and export of goods and vehicles. The main document for registering the movement of goods and vehicles across the customs border of the Russian Federation is. In the Customs Code, customs statistics are divided into customs statistics of foreign trade and special customs statistics. Documents and information for statistical purposes are presented in accordance with the provisions of the Labor Code on the procedure for customs clearance and customs control. Information provided for statistical purposes is confidential (Article 214 of the Labor Code). For offenses related to the maintenance of customs statistics, which are simultaneously violations of customs rules or offenses encroaching on the normal activities of the customs authorities of the Russian Federation, persons are liable in accordance with the Labor Code (Article 215 of the Labor Code).

Encyclopedia of Russian and international taxation. - M.: Lawyer. A.V. Tolkushkin. 2003.

See what "CUSTOMS STATISTICS" is in other dictionaries:

CUSTOMS STATISTICS- (CUSTOMS STATISTICS) component of the foreign economic system. communications, accounting for the export and import of goods. In Russia, the main primary document I.e. Cargo customs declaration (CCD). Customs declarations are received directly from customs or through... ... Glossary of terms for cargo transportation, logistics, customs clearance

Collection and processing of information on the movement of goods across the customs border of the country, as well as presentation and publication of customs statistics data. See also: Statistics of foreign economic relations Financial Dictionary Finam... Financial Dictionary

CUSTOMS STATISTICS OF FOREIGN TRADE Legal encyclopedia

CUSTOMS SPECIAL STATISTICS- (see SPECIAL CUSTOMS STATISTICS) ...

Customs statistics of foreign trade of the Russian Federation- 1. For the purpose of analyzing the state of foreign trade of the Russian Federation, monitoring the receipt of customs payments into the federal budget, currency control, analyzing the dynamics and trends in the development of foreign trade of the Russian Federation, its trade and ... Official terminology

Branch of state statistics; is carried out in accordance with Art. 112 of the Labor Code and other acts of legislation of the Russian Federation on customs matters. When maintaining customs statistics, a methodology is used that ensures international comparability of data and... ...

CUSTOMS STATISTICS OF FOREIGN TRADE- collection and processing of information on the movement of goods across the customs border of a given country, as well as. presentation and publication of customs statistics; carried out in order to provide the highest bodies of state power, other state bodies... Encyclopedic Dictionary of Economics and Law

Customs statistics maintained by the customs authorities of the Russian Federation along with customs statistics of foreign trade in the manner determined by the State Customs Committee in order to ensure the solution of other tasks assigned to the customs authorities of the Russian Federation (Article 213 of the Labor Code) ... Encyclopedia of Russian and international taxation

Special customs statistics- in the Russian Federation, information from customs authorities used to ensure the solution of special tasks assigned to these authorities, and collected in the manner determined by the State Customs Code of the Russian Federation. See also: Statistics of foreign economic relations Financial Dictionary Finam... Financial Dictionary

FOREIGN TRADE CUSTOMS STATISTICS- CUSTOMS STATISTICS FOR FOREIGN TRADE… Legal encyclopedia

Books

- Customs statistics. Textbook, Pozhidaeva Elena Sergeevna. The methodological principles of customs statistics of foreign and mutual trade of member states of the Eurasian Economic Union have been studied, issues of organizing and maintaining…

Part 1. Customs statistics of foreign trade

Topic 1. The role and place of customs statistics

IN scientific term "statistics" 1 was introduced by the German scientist Gottfried Achenwall in 1746, proposing to replace the name of the course “State Studies” taught at German universities with “Statistics”, thereby marking the beginning of the development of statistics as a science and academic discipline.

IN Currently, this term is used in 4 meanings:

1) science that studies the quantitative side of mass phenomena and processes in inextricable connection with their qualitative content - an academic subject in higher and secondary specialized educational institutions;

2) a set of digital information characterizing the state of mass phenomena and processes of social life; statistical data, presented in the reports of enterprises, organizations, sectors of the economy, as well as published in collections, reference books, periodicals and on the Internet, which are the result of statistical work;

3) branch of practice(“statistical accounting”) of collection,

processing, analysis and publication of mass digital data on a wide variety of phenomena and processes of social life2;

4) a certain parameter of a number of random variables obtained by a certain algorithm from the results of observations, for example, statistical criteria (critical statistics) used when testing various hypotheses (presumptive

statements) regarding the nature or values of individual indicators of the data under study, features of their distribution, etc.3

As a scientific direction, customs statistics is characterized by a subject

object, purpose, objectives and methods of research. Customs statistics has a subject and methods common to all statistical disciplines.

The subject of customs statistics is mass phenomena (statistical aggregates), as well as the numerical expression of the patterns manifested in them, and its methods are based on the law of large numbers, which makes it possible to use the tools of statistical theory in the analysis of customs statistics data, and to assess the reliability of statistical estimates and conclusions – apparatus of mathematical statistics. Customs statistics, like other branch statistical disciplines, is distinguished as an independent discipline due to its separate object of study, goals and objectives.

1 From lat. status – state, state of affairs; originally the term was used in the meaning of “political state” 2 This activity is carried out at a professional level by government statistics–

The Federal State Statistics Service (FSGS) and the system of its institutions, organized along administrative-territorial lines, as well as departmental statistics(at enterprises, departments, ministries, etc.)

3 The term “statistics” as a parameter, as a statistical criterion is used mainly in mathematical statistics, some of them (χ2, t, etc.) are discussed in the relevant topics of this manual

The object of study of customs statistics is foreign trade of the Russian Federation and the activities of customs authorities.

The purpose of customs statistics is to provide the leadership of the Federal Customs Service (FCS), legislative and executive authorities with information on the state and development of foreign trade of the Russian Federation (RF) and on the activities of customs authorities. Accordingly, 2 sections of customs statistics are defined: customs statistics of foreign trade And special customs statistics(see Fig. 1).

Customs statistics

Customs statistics of foreign trade

Statistical quantities and their observation

System of indicators and characteristics

Distribution series

Dynamics series

Relationships

indicators

Index method

Features of cost accounting of goods

Special customs statistics

Statistics

declaration

Statistics of customs payments

Currency control statistics

Statistics of customs offenses

Statistics on the movement of vehicles and individuals

Other types of special customs statistics

Rice. 1. Sections and subsections of customs statistics

Maintaining and organizing customs statistics is one of the functions of customs authorities. The legal basis for maintaining customs statistics is

Customs Code (TC) [ Error! Link source not found. ], the new version of which came into force on January 1, 2004. Data from special customs statistics are used by customs authorities exclusively for customs purposes.

The objectives of customs statistics of foreign trade are:

– assistance in the development of foreign economic activity (FEA), expansion of foreign trade relations, development of foreign trade policy of the Russian Federation;

– development of methodological principles of analysis and a system of indicators characterizing the size, dynamics and structure of foreign trade;

– ensuring complete and reliable accounting of data on exports and imports of the Russian Federation;

– analysis of the main trends, structure and dynamics of foreign trade commodity flows of the Russian Federation in conjunction with an analysis of its macroeconomic situation and world market conditions;

– information support of executive and legislative authorities with data on customs statistics of foreign trade for their decision-making in the field of customs policy of the Russian Federation and state regulation of foreign trade of the Russian Federation;

– presentation of customs statistics of foreign trade to international organizations;

– presentation of data on customs statistics of foreign trade for the purpose of monitoring the receipt of customs payments into the federal budget, currency control, development of the balance of payments of the Russian Federation;

– calculation of various kinds of index indicators (for example, price indices and physical volume of foreign trade, etc.);