How the tax office reconciles VAT. How to check the VAT return using the balance sheet? A few nuances that you should pay attention to when checking your declaration

Reconciliation of the VAT declaration with the purchase book and sales book in 1C: Accounting 3.0

For the VAT declaration, several dozen control ratios are legally established to check the correctness of completion.

When filling out and checking a VAT return, you should always take into account the specifics of VAT accounting in each individual organization (application of different VAT rates, maintaining separate accounting VAT, etc.) and draw up algorithms for controlling VAT accounting in accordance with the existing features. In this example, we will consider an organization using OSNO, operating only with a VAT rate of 18%.

In the 1C: Enterprise Accounting 3.0 program, a special verification module is built into the regulated report “VAT Declaration”:

If there are errors in the control ratios, the form provides a list of only erroneous ratios.

Also, when filling out a VAT return, 1C users are recommended to report “Analysis of the state of tax accounting for VAT”. This report is intended to verify the correctness of the registration of facts economic activity regarding VAT, filling out a purchase book and a sales book, filling out a tax return. The report shows current data after all regulatory operations for VAT accounting.

The report presents the structure of the tax base for VAT. Individual blocks of the scheme reflect the accrual or deduction of VAT. The yellow background shows the amounts of calculated VAT, and the gray background shows the amounts of non-calculated VAT.

How to check your VAT return before submitting it?

By clicking on each individual block, you can view its transcript.

The tax return analyzes Section 3:

- Dt 62.01×18/118 = Line code 10, Column 5 “Tax amount in rubles”;

- Dt 62.01×100/118 = Line code 10, Column 3 “Tax base in rubles.”

3. SALT Kt 62.02×18/118 = Dt 76AV (in the tax return this corresponds to line 070 of section 3, column 5 “Tax amount in rubles”);

SALT Kt 62.02 (in the tax return this corresponds to line 070 of section 3, column 3 “Tax base in rubles”).

4. In SALT account 19 there should be no balances at the end of the period (in the declaration this is line 120, section 3, column 3 “Tax amount in rubles”;

5. Dt 68.02 (forming SALT) = Section 8: information from the purchase book Line 190;

6. Kt 68.02 (we form SALT) = Section 9: information from the sales book Line 260.

If in practical activities the organization has other income, then when selling goods, works and services, the proceeds of which are classified as other income, the output VAT is accounted for in account 91.02 (see below for an example of RTiU entries for other income).

For further analysis of VAT calculated on other income, you can use the analysis of account 91.02 or account 68.02. When analyzing account 91.02, you need to pay attention to the revolutions according to Dt 68, and when analyzing account 68.02 - to the revolutions according to Kt 91.

In the declaration, the reflection of VAT data on accounts 91.01 and 91.02 can be tracked as follows:

- (SALT Kt 90.01.1 + SALT Kt 91.01) x 100/118 = line 10, section 3, column 3 “Tax base in rubles”;

- (SALT Kt 90.01.1 + SALT Kt 91.01) x 18/118 = line 10, section 3, column 5 “Tax amount in rubles”;

You can also analyze the data in line 10 of column 5 “Tax amount in rubles” taking into account account 91.02, which reflects VAT calculated on other income:

OSV Dt 90.03 + analysis of account 91.02 (revolutions Dt 68).

I hope this article was useful to you. If you still have questions, SITEK specialists are always ready to provide advice on working with the program.

____________________________________________________________________________

Author of the article: Specialist of the support department Anna Alexandrova. Article updated 09.26.2016

Checking the VAT return

All organizations that pay Value Added Tax are required to calculate the amount of tax and submit a declaration by the 25th of the quarter. Let us remind you that the VAT return is submitted only! electronic. From January 1, 2016, if the declaration is submitted in paper form, it is considered not submitted.

Any tax accountant must learn how to calculate VAT using a balance sheet (SALT).

Below we will describe how to do this.

- Use the VAT Accounting Assistant to process all invoices (including advance invoices).

- Generate SALT for the quarter.

- Pay attention to account 62.02 - these are advances received; this account must be reconciled with SALT in account 76.AB.

There are several cases when VAT is not calculated for payment of advances received; these are cases prescribed in Article 154 of the Tax Code of the Russian Federation.

If your transactions do not fall under the scope of this article, VAT on advances received should be recorded under Dt 76 of the account (see turnover by counterparties in SALT Kt 62.02).

- Create an analysis of account 19. Only the amount in correspondence with account 68 should be taken into account.

So the calculation: Turnover by Dt 90.03(sales tax) + Turnover Dt 76.AV(tax payable on advances received) + Turnover Dt 76.VA(reinstated tax on advances issued in the previous period) - Turnover by Kt 19(input VAT from the supplier: remember point 4 described above) - Turnover by Kt 76.AV(recovered VAT on advances received) - Turnover by Kt 76.VA(tax deductible on transferred advances)

As a result of these calculations, you will get the amount of your tax.

(if your organization also carried out sales through 91 accounts during this period, you must add the amount of tax that was posted through the transaction Dt 91.02 Kt 68.02)

/ "Accounting encyclopedia "Profirosta"

09.10.2017

Information on the page is searched for by the following queries: Accountant courses in Krasnoyarsk, Accounting courses in Krasnoyarsk, Accountant courses for beginners, 1C: Accounting courses, Distance learning, Training of accountants, Training courses Salaries and personnel, Advanced training for accountants, Accounting for beginners

Accounting services, VAT declaration, Profit declaration, Maintenance accounting, Tax reporting, Accounting services Krasnoyarsk, Internal audit, OSN reporting, Statistics reporting, Pension Fund reporting, Accounting services, Outsourcing, UTII reporting, Bookkeeping, Accounting support, Provision of accounting services, Assistance to an accountant, Reporting via the Internet, Preparation declarations, Accountant needed, Accounting policy, Registration of individual entrepreneurs and LLCs, Taxes of individual entrepreneurs, 3-NDFL, Organization of accounting

Look for related operations in them, next to which there is a possible error code “2”, and explain the inconsistencies. In some cases, one table may be attached to the requirement. For example, the seller declared in the declaration the deduction of advance VAT, but the declaration does not contain data on its accrual. The inspection will send such a seller a table with an extract from section 8 “Information from the purchase book...”, where the registered invoice for the advance payment with error code “2” will be indicated. Check whether you charged VAT on the advance, in what period and whether this is reflected in the VAT return. Having received an email from the Federal Tax Service Inspectorate about the provision of explanations, the payer may not send the receipt himself, but entrust this to his authorized representative Code “3”. Inconsistency of data about one transaction in parts 1 and 2 of the log of issued and received invoices.

Explanation of VAT line 130 and 90

Add to favoritesSend by email Line 090 of the VAT return in section 3 must be completed when restoring the tax, if the taxpayer-buyer uses the right to deduct “advance” VAT when transferring an advance payment to the supplier. Let's consider how to correctly formulate such a tax amount and reflect it in the declaration.

Application of VAT deduction on advances to the supplier Restoration of VAT on advances to the supplier The procedure for filling out line 090 of the VAT return Results Application of VAT deduction on advances to the supplier Provisions of paragraph 12 of Art. 171 of the Tax Code of the Russian Federation provides the taxpayer with the right to apply tax deduction VAT amounts included in advances transferred to suppliers. Required terms application of the deduction are the following points (clause.

9 tbsp.

Explanations for VAT returns from 2017

VAT differences upon prepayment, No. 3

- New forms of VAT accounting have appeared: when will they come into force?, No. 3

- New invoices, their accounting journal and books of purchases and sales, No. 3

- Errors in invoices? Needs to be fixed, No. 3

- Does the amount difference increase the VAT base, No. 3

- Optimization of VAT for non-trading organizations, No. 2

- Prepayment and shipment in one quarter: what to do with VAT?, No. 2

- Internet conference on VAT amendments: report, No. 1

- 2011

- October VAT amendments are transferred to the declaration, No. 24

- We calculate the VAT base and deductions when the price is in foreign currency or in yuan. e., No. 21

- Adjustment invoice form: gift from the Federal Tax Service, No. 20

- Agreement in

How to fill out line 090 of section 3 of the VAT return

- Preparation of VAT report, No. 19

- VAT upon assignment of a claim, No. 18

- YOU also put in a word about VAT deductions for inseparable improvements, No. 17

- Update of VAT accounting documents, No. 17

- New rules for VAT document flow and more, No. 16

- Revelations from YOU about VAT rates and deductions, No. 16

- When to charge VAT and when to deduct it: conclusions of the Supreme Court, No. 15

- What to do if you receive an adjustment invoice instead of a corrected one or vice versa, No. 13

- Main VAT document: correctly and on time, No. 11

- Fill out an invoice? Easy!, No. 8

- Near zero, or at what rate to charge VAT when working with international organizations, № 8

- During an on-site inspection, the VAT refunded by camera was taken away: what to do?, No. 6

- Fill out an invoice? Elementary!, No. 4

- 2013

Announcement

Tax Code of the Russian Federation. Submitting an updated declaration as part of a desk audit of the primary declaration before drawing up the report is equivalent to correcting independently discovered errors. After all, since the desk inspection report has not yet been drawn up, the errors discovered by the inspectors have not been recorded. Letter of the Federal Tax Service dated November 20, 2015 No. ED-4-15/20327.

Attention

And if, for example, he considers that you have underestimated the tax base and underpaid the tax, you will be fined by the tax authority. 122 of the Tax Code of the Russian Federation. Sometimes inspectors scare organization officials with an administrative fine in the amount of 2,000 to 4,000 rubles.

Camera: we provide explanations on the VAT declaration

It is conducted for intermediary operations, as well as for operations of developers and forwarders (if they include only their remuneration in revenue). For example, an intermediary commission agent must register in part 2 of the accounting journal an invoice received from the principal.

And invoices issued to customers must be reflected in part 1 of the accounting journal. Data on invoices received and issued within the same intermediary transaction must be comparable.

If there are discrepancies, the inspection will attach to its request a table with an extract from section 10 “Information from the log of issued invoices” and/or a table with an extract from section 11 “Information from the log of received invoices” indicating information on “problematic » operations by entering code “3” in the corresponding lines. Code "4".

In section 3 of the VAT return, the indicator in column 3, line 200 “Total amount of tax payable to the budget under section 3” must be equal to the difference between the indicator in column 5, line 110 “Total amount of tax calculated taking into account the restored tax amounts...” and the indicator in column 3 line 190 “Total amount of tax subject to deduction” RUB 80,000.00.<

VAT exempt, No. 15

- Let's continue the conversation: we solve VAT issues together, No. 15

- VAT on reimbursement of transportation costs, No. 14

- We solve VAT issues together, No. 14

- How to correct errors in VAT reporting, No. 13

- Special intermediary and invoice journal, No. 12

- Invoice for VAT from inter-price difference: attention to the amount of tax!, No. 12

- VAT deduction: immediately or later?, No. 11

- 10% or 18%? How to determine the VAT rate when selling a toy with a logo, No. 11

- Some consequences of transferring VAT deductions, No. 11

- We accept VAT for deduction in parts, No. 11

- Camera revealed a deduction for an incorrect VAT rate: what to do, No. 7

- And again about VAT, No. 6

- “Non-competitive” sale to a bankrupt: is there VAT?, No. 6

- VAT: tips and solutions on deductions and accruals, No. 5

- 2014

Explanation of VAT on pages 130 and 090

Tax Code of the Russian Federation. And if you received a request to submit documents, but did not comply with it on time, the organization may be fined 200 rubles. for each document not submitted. 1 tbsp. 126 of the Tax Code of the Russian Federation. Other articles from the magazine "MAIN BOOK" on the topic "VAT - accrual / deduction / refund": 2018

- Deduction of VAT from the seller when returning goods by simplifier, No. 8

- The transaction was declared invalid: in what period should VAT be adjusted, No. 7

- Safe share of VAT deductions, No. 6

- How can sellers - participants in the tax-free system fill out a VAT return, No. 3

- Address in the invoice: regular clarifications from the Ministry of Finance, No. 3

- VAT amendments: what to prepare for, No. 1

2017

Cost of purchases according to the invoice, difference in cost according to the adjustment invoice (including tax), in the currency of the invoice (Page 170) Amount of tax according to the invoice, difference in the amount of tax according to the adjustment invoice accepted for deduction , in rub. and cop. (Page 180) For reference: Possible error code 1 2 3 4 13 14 18 19 20 99 01 37 08/09/2015Data that raises doubts among tax authorities 08/19/2015 7713587777 70 800 10 800 4The error code helps to understand what they doubt tax authorities . Code “4” indicates that an error may have been made when registering the invoice.

It is explained in parentheses exactly which of his data are in doubt. The number in brackets indicates a column in the same table with a dubious indicator 185 01 181Data that raises doubts among tax authorities 09.24.2015 09.24.2015 7716777788 212 400 32 400 4The error code helps to understand what tax officials doubt.

How to check your VAT return by amount

Most of the tax authorities' complaints are caused by inconsistencies in the amounts in the declaration.

There are several ways to check the amounts indicated in the VAT return. Two of them are the most frequently recommended:

- Checking data on the accounting registers generated for the period: balance sheet (SAS) and analysis of account 68.2;

- Checking the report of control ratios (CRs) approved by the Federal Tax Service of the Russian Federation (attachment to the letter of the Federal Tax Service of the Russian Federation dated March 23, 2015 No. GD-4-3/4550@, additional letter of the Federal Tax Service of the Russian Federation dated April 6, 2017 No. SD-4-3/6467@ ).

Let's take a closer look at both methods.

Checking turnover information

Although the courts have repeatedly confirmed that accounting registers are not taxable and that tax authorities, during their desk audits, should not rely on them and demand them from taxpayers, for an accountant the simplest and proven method for checking a VAT return for years is reconciliation of information with the SALT for the corresponding period .

Data from accounting registers, with correct accounting and tax accounting, give the values indicated in the report.

How to check the VAT return on turnover? Check the SALT figures for the accounts:

- 90 and 91 - sales volume at specific tax rates;

- 60, 62 and 76 - amounts of advances and VAT on them;

- 19 - amounts of deductions;

- 68.2 - all amounts that take part in the calculation and give the final result.

So, you have filled out your VAT return - how to check? If simple VAT is 18% (from 01/01/2019 - 20%), check the data on the report lines using the following formulas:

Table 1

Checking data on account analysis 68.2

Generate an analysis of account 68.2 (VAT sub-account). By debit, this report shows VAT deductible and transferred to the budget, by credit - the amount of calculated VAT. Use table 2 with explanations for the analysis of account 68.2 according to the applicable lines in section 3 of the declaration:

table 2

|

Cor. check |

Explanations on Dt |

Line in the declaration |

Explanations on CT |

Line in the declaration |

||

|

Balance at the beginning of the period |

VAT refundable for the previous period |

VAT payable for the previous period |

||||

|

VAT on OS purchase |

||||||

|

VAT on the purchase of MPZ |

VAT restored |

|||||

|

VAT on purchase of services |

||||||

|

VAT paid at customs upon import |

||||||

|

VAT paid at customs when importing from the Customs Union (CU) |

||||||

|

51, main account |

Payment of VAT to the budget |

VAT refund from the budget |

||||

|

VAT on shipments on advances from buyers |

VAT on buyer advances |

|||||

|

VAT on advances paid to suppliers |

Crediting VAT on advances to suppliers upon receipt of goods, works, and services from them |

|||||

|

VAT on sales |

||||||

|

VAT on other sales |

||||||

|

Period transactions |

||||||

|

balance at the end of period |

VAT recoverable |

VAT payable |

See Table 3 for specific clarifications:

Don't know your rights?

Table 3

Reconciliation of the declaration against control ratios

Control ratios (CRs) for checking declarations by tax authorities have been published, and they also need to be used during verification.

The number of formulas used from the Tax Code depends on the status of the taxpayer and the nature of the transactions.

Table 4

|

Formula KS |

Note |

|

|

Data reconciliation between sections 1-7 and 8-12 |

||

|

Page 060 section 2 + page 118 sec. 3 + pages 050 and 080 sec. 4 + page 050 and 130 sec. 6 = page 260 + page 270 sec. 9 |

If the VAT amounts in Sec. 9 and in section. 2-6 require clarification |

|

|

Page 190 section 3 + pages 030 and 040 sec. 4 + pages 080 and 090 sec. 5 + pages 060, 090 and 150 sec. 6 = page 190 sec. 8 |

If the residues are unequal in Sec. 8 and in section. 3-6 clarification required |

|

|

Sec. 8: page 180 = page 190 |

VAT deductible = total as of last. section page 8 |

|

|

Sec. 9: page 200 = page 260; page 210 = page 270 |

VAT payable = total as of last. section page 9 |

|

|

Tax agents: |

||

|

Page 060 section 2 = page 200 and 210 sec. 9 − code “06” on page 010 |

VAT payable |

|

|

Page 180 section 3 = page 180 sec. 8 − code 06 on page 010 |

VAT for deduction - letter of the Ministry of Finance dated October 23, 2013 No. 03-07-11/44418 |

|

|

For importers: |

||

|

Page 150 section 3 = page 180 sec. 8 − code 20 on page 010 |

Correct codes: imports from EAEU countries - 19; from other countries - 20 |

|

|

Page 160 section 3 = page 180 sec. 8 − code 19 on page 010 |

||

So that the tax inspector has fewer questions when checking the VAT return and does not need to make a requirement to provide explanations for discrepancies, it is better to check the report before sending it to the tax office.

The article suggests the most common methods of data verification:

- on accounting registers: balance sheet and account analysis 68.2;

- according to the Constitutional Code, with the help of which tax authorities carry out electronic control of the correctness of filling out the VAT return submitted by you.

How can you check the correctness of the VAT return and Profit from SALT?

1. When filling out a VAT return, the data in column 5 on lines 010–040 of section 3 must correspond to the transaction data Debit 90-3 (91-2) Credit 68 subaccount “VAT calculation”. According to column 5, line 070 of section 3 must correspond to the transaction data Debit 76 subaccount “Calculations for VAT from advances received” Credit 68 subaccount “Calculations for VAT”. On line 120, transaction data Debit 68 subaccount “Calculations for VAT” Credit 19, on line 130 posting data Debit 68 subaccount “Calculations for VAT” Credit 76 subaccount “Calculations for VAT on advances issued”, on line 170 Debit 68 subaccount “Calculations for VAT" Credit 76 subaccount "Calculations for VAT on advances received." 2. When filling out an income tax return, the data on lines 011–014 must correspond to the data in the posting Debit 62 Credit 90-1 (91-1) minus the VAT amount. On lines 101–107, the remaining data on the debit turnover of account 91-1, taken into account in the NU. For lines 010–030, transaction data Debit 90-2 Credit 41 (43), Debit 91-2 Credit 10 (01). For lines 040–041, transaction data Debit 90-2 Credit 44 (26). On lines 200–206, the remaining data on the credit turnover of account 91-2, taken into account in the NU.

How to prepare and submit a VAT return

Appendix 1 to sheet 02 reflects the organization's revenue according to tax accounting data.

Lines 010–040

Lines 011–014 are for sales revenue*.

In this article I want to tell you a little about checking your VAT return. Of course, this is a complex and multifaceted process, which largely depends on the specifics of the organization’s activities and the composition of the operations performed. But, nevertheless, there are some basic techniques, without knowledge of which it will not be possible to understand the logic of filling out and checking this report. Now we will talk about one of these techniques, namely, reconciling the VAT return with information on account 68.02. We will consider an example based on 1C: Enterprise Accounting 8 edition 3.0, but the information provided is also relevant for other 1C version 8 programs.

So, in order to start checking, we need to open the completed VAT return and generate an “Account Analysis” report for account 68.02 for the tax period.

The “Credit” column of this report reflects the amount of calculated VAT, and the “Debit” column shows the amount of VAT claimed for deduction and transferred to the budget.

We will check the “account analysis” with section 3 of the VAT return.

Line 010 of Section 3 of the VAT return reflects the amounts of the tax base and the tax calculated on the sale of goods, works, and services at a rate of 18%. In our case, the organization carried out sales only at this rate, so the amount in line 010, in general, should coincide with the turnover of account 68.02 and account 90.03.

Also in the “Credit” column of the “Account Analysis” report we see the turnover on account 76.AB, i.e. VAT calculated on the amounts of advances received from buyers. Accordingly, we should see the same amount in the declaration on line 070.

Now let's check the tax deductions. The amount of VAT charged to our organization when purchasing goods, works, services is reflected in account 68.02 in correspondence with account 19, and in the declaration it falls on line 120.

The amount of VAT on offset advances from customers is displayed in the “Debit” column in correspondence with account 76.AB and in line 170 of section 3 of the VAT return.

I would like to draw your attention to several important points:

- if during the tax period there were refunds of advances to buyers, then it must be remembered that the amounts of such refunds will be reflected on line 120 of section 3 of the VAT return, i.e. together with VAT on purchased values. Accordingly, when reconciling the declaration and analyzing account 68.02, there will be discrepancies by the same amount in turnover with accounts 19 and 76.AB (refund amounts will be reflected in correspondence with account 76.AB, but in the declaration they will appear in the line that we check with count 19).

- if you want to check the total turnover on the debit and credit of account 68.02 with the total amounts of calculated VAT and VAT deductible on the declaration, then you need to remember that in the account analysis in the “Debit” column also reflects the amounts of paid VAT, which are not reflected in the declaration (turnover with a score of 51).

- the final balance in account 68.02 will coincide with the amount of tax payable according to the declaration if there is no debt or overpayment for previous tax periods.

Of course, the situation that we have considered is quite simple and illustrates only the basic principles of VAT verification. If VAT recovery operations, accounting at different tax rates or various returns are added, then the reconciliation becomes more complex and interesting. But I highly recommend checking the declaration with an analysis of account 68.02 for one simple reason: the declaration is filled out using information from the VAT tax registers, and the account analysis is performed according to the accounting entries. Unfortunately, in practice, I very often encounter discrepancies in these amounts, which are caused by errors in accounting, manual entries and adjustments. In this case, a simple reconciliation will help you find shortcomings, understand their causes and submit a correct VAT report.

If you want more useful information about working with VAT, about filling out and checking the declaration in the 1C: Enterprise Accounting 8 program, and you would also like our written consultations on this topic, then we highly recommend our video course

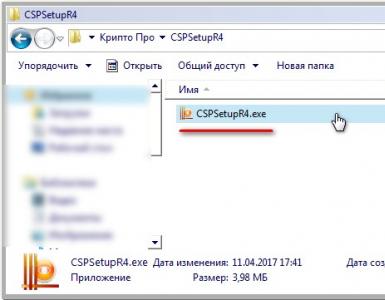

Step 1. Preliminary preparation for drawing up a declaration

Before preparing a tax return for the reporting period, you must complete the following steps:

- Carry out all documents entered into the 1C 8.2 database for the reporting period;

- Close the month for the reporting period;

- Check the VAT return for “turnover” to see if accounts are closed in the menu Reports– Turnover balance sheet:

Step 2. Checking that the information about the organization is filled out correctly

You can check the correctness of filling in information about the Organization through the Menu Company → Organizations.

Step 3. Checking the execution of all primary documents in 1C 8.2

It is advisable to “open” the main documents for the receipt of goods (works, services) and for sale in 1C 8.2.

Step 4. Restoring the sequence of documents in 1C 8.2

Repost all documents for the reporting period in 1C 8.2 using one of the reposting methods:

- Reposting documents of a certain type for a certain period (menu Operations – Posting documents);

- Reposting documents selected for a specific type of document and for certain elements of documents (menu Service – Group processing of directories and documents);

- Complete re-processing of documents for a certain period (menu Service -).

Before posting documents, create an archive copy of the database.

Step 5. Checking the status of mutual settlements with counterparties

Check that mutual settlements with suppliers and customers are reflected correctly in 1C 8.2. To do this, first create SALT for accounts with suppliers (60.01 and 60.02) and with customers (62.01 and 62.02). Then generate a report Subconto analysis and check mutual settlements for each counterparty, contracts and settlement accounts.

Step 6: Checking the completeness of invoice registration

It is necessary to check the availability of invoices according to receipt documents in 1C 8.2. First form Report on the availability of invoices. Next, “open” the original invoices with:

- Journal of invoices received;

- Journal of invoices issued.

Step 7. Formation of a purchase book and a sales book

Stage 1. Checking the completeness of the invoices: Invoices for advances received;

Stage 2. Checking the completion of VAT regulatory documents: Document VAT write-off;

Stage 3. Generating purchase and sales ledger entries:

- Filling out the document;

- Filling out the document.

Step 8. Express check of VAT accounting status

Start checking the Purchase Ledger and the Sales Ledger. Correct any identified errors.

Step 9. Carry out an arithmetic check of the VAT calculation and reconciliation of accounting and accounting records

It is advisable to check the arithmetic calculation of VAT in accordance with the rates. This can be done by filling out the “internal” table on the basis and checking the data in it with Account analysis 68.02 “Value added tax”:

Stage 1. Checking VAT calculated on sales

Generate a report Turnover balance sheet according to accounts 90.01.1, determine the tax base in terms of tax rates:

Dt 90.03 Kt 68.02, Dt 91.02 Kt 68.02.

- VAT = 1 900 428* 18 \ (100 + 18)= 289,895.79 rub.

- Total calculated VAT = 289,895.79 rubles.

- In our example, VAT calculated arithmetically corresponds to the set of transactions Dt 90.03 Kt 68.02

Stage 2. Checking VAT calculated on advances received from buyers

Generate a report on accounts 62.02 and 62.32, determine the tax base for calculating VAT on advances received. As a rule, this base is the credit turnover of these accounts:

Dt 76.AV Kt 68.02. Let's check the data using our example:

- The amount of advances received on account 62.02 is RUB 720,000.00.

- Tax amount = 720,000.00 * 18% \ 118% = 109,830.51 rub.

Data can be entered for comparison into an “internal” file:

Stage 3. Checking VAT accepted for deduction when purchasing goods (works, services)

Generate a report in 1C 8.2 Turnover balance sheet for subaccounts to account 19, determine the features of inclusion in the purchase book for invoices received. For example, for fixed assets that have not been put into operation, the “input” VAT should be listed on the balance at the end of the tax period:

Data can be entered for comparison into an “internal” file:

Stage 4. Checking VAT accepted for deduction when offsetting advances received from buyers

Generate a report Account analysis for accounts 62.02 and 62.32, determine the amount of advances offset for the calculation of VAT to be deducted. As a rule, this base is the debit turnover of these accounts:

Calculate VAT based on the rate, it must correspond to the set of transactions Dt 68.02 Kt 76.AV. Let's check the data from our example:

- The amount of credited advances from customers on account 62.02 is RUB 442,300.00.

- Tax amount = 442,300.00 * 18% \ 118% = 67,469.49 rubles.

- In our example, there are no advances on account 62.32.

Data can be entered for comparison into an “internal” file:

Stage 5. Checking VAT accepted for deduction on advances issued to suppliers

To determine the amount of advances on which VAT can be deducted, you can use accounts 60.02 and 60.32, from it you can quickly select the amounts of advances issued to suppliers (turnovers in the debit of accounts):

Calculate VAT based on the rate, it must correspond to the set of transactions Dt 68.02 Kt 76.VA. Let's check the data from the example:

- VAT = 118,000.00* 18\118 = 18,000.00 rub.

- In our example, VAT calculated arithmetically corresponds to the amount of the set of VAT entries accepted for offset against advances - Dt 68.02 Kt 76.VA.

Data can be entered for comparison into an “internal” file:

Stage 6. Verification of VAT recovered for payment from advances issued to suppliers

To determine the amount of advances for which it is necessary to restore VAT for payment, you can use Turnover balance sheet for accounts 60.02 and 60.32, from it you can quickly select the amounts of offset advances issued to suppliers (account credit turnover):

Calculate VAT based on the rate, it must correspond to the set of transactions Dt 76.VA Kt 68.02. Let's check from the example:

- VAT = 118,000.00 * 18\118 = 18,000.00 rub.

- In our example, VAT calculated arithmetically corresponds to the amount of the set of VAT entries calculated by offsetting advances issued - Dt 76.VA Kt 68.02.

Data can be entered for comparison into an “internal” file:

Stage 7. Reconcile the calculated VAT data in the accounting department with tax accounting registers

Data on calculation of accrued VAT can be presented in the table:

Data on calculation of accrued VAT needs to be compared with Sales book:

Let's compare the data from the example:

- VAT accrued for payment according to accounting accounting = RUB 417,726.30

- VAT accrued for payment according to NU = RUB 417,726.30

- The accrued VAT amounts are the same.

Data on VAT calculation for deduction can be presented in the table:

Data on VAT calculation for deduction can be compared with Purchase book:

Let's compare the data from the example:

- VAT deductible according to accounting system = RUB 302,446.56

- VAT deductible according to NU = RUB 302,446.56

- The VAT amounts to be deducted are the same.

VAT payable or refundable is calculated as the difference between accrued VAT and deductible VAT: VAT = 417,726.30 – 302,446.56 = 115,279.74 rubles. Check according to our example.